The Secularly Stagnating Arguments of Olivier Blanchard and Larry Summers

.

.

.

Note: This was Published April 6th 2021. It has not been updated to reflect changes in my life circumstances, the newsletter or in the wider world. To subscribers- I will return next week with new pieces sent out on Ghost. I’m leaving Substack.

Guest piece by Joel Rabinovich

_____________________________________

Designing Automatic Triggers for State and Local Policy.

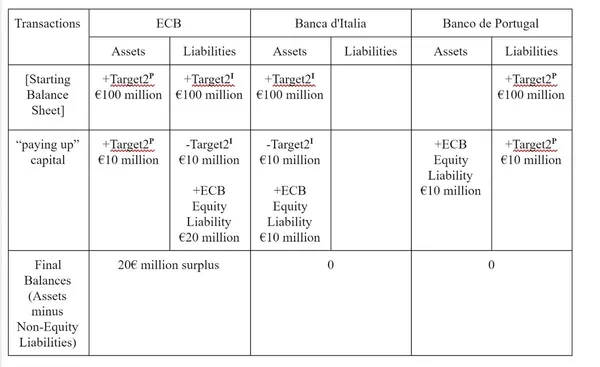

However, Eurozone Member States Can

Full of Sound and Fury, Signifying Nothing

How Do You Solve a Problem like Direct Payments?

Republished After Corrections

Guest Piece

The Federal Reserve’s “Useless Accounting Gimmick” Comes Back to Bite