When Do We Know Employment has Fully Recovered From the Coronavirus Depression?

Designing Automatic Triggers for State and Local Policy.

A consistent theme of Notes on the Crises is the ways that we can redesign fiscal policy, monetary policy- and even non-financial regulation- to better manage macroeconomic and social instability. Something I’ve talked about regularly — both in the context of fiscal cliffication and in other contexts — is the idea of tying specific policies to “automatic triggers- “autonomous stabilizers” — rather than relying on congressional discretion. Usually I refer to these in the context of fiscal policy. The trouble is that improving policy in this way at the state and local level is limited by the financial constraints those governments face. This results in an inhibition which I’ve constantly bemoaned and suggested various policy levers for alleviating.

As a result, I’ve spent less time focusing on how state level policy could be improved without fundamentally changing the financial parameters they operate under. Yet, non-financial regulation is a tool that is nearly as available to state and local governments as it is to the federal government. Meanwhile, the possible negative fiscal effects of non-financial regulation are varied and complex, depending on the policy. Thus, there is room to improve non-financial regulation. And where there is room to improve non-financial regulation, there is room to tie them to automatic triggers rather than relying on the discretion of state and local legislatures.

The downside of designing state and local autonomous stabilizers is that state and local data is often of less quality than national data. While we have very precise measures of various different definitions of unemployment- or labor market “slack” more generally- at the national level, our state and local measures are more imprecise. Thus, we need a little creativity and contextual judgment to come up with the right measures to attach automatic triggers to. In this piece, I’m going to examine the various measures available at the state level and suggest the best uses of that data.

In my view the most important non-financial regulations in the ongoing coronavirus crisis are regulations that target evictions. I wrote a lot about evictions over the summer and returned to the topic in the fall but haven’t talked about more recent events. The issue of accumulating rental debt has still not been dealt with and our ongoing federal eviction moratorium still requires those who have been evicted to know about and submit affidavits requesting protection from eviction, which will inherently miss many people. As I wrote last fall, eviction protections are very important to slowing the spread of coronavirus itself.

Local advocates of eviction protections thus need good policy rationales for automatic triggers of stronger eviction moratoriums. What’s needed is firm policies that lead to strong protections for the duration of the Coronavirus crisis. Policy, being a balance of power, can’t deliver us an ideal. For example, many I’m sure would argue that eviction moratoriums should be permanent, as evictions are always a threat to public health and driver of racial and economic disparities. These arguments have valid evidence behind them. It would follow that the essentially financial problem of rent for a landlord (and perhaps the servicing of their mortgage) should be solved in other ways, ones which have no public health dangers. Yet, we all know that no legislature will pass such a law given the current balance of power between tenants movements and landlords.

In this sense automatic triggered policies can be seen as a middle ground between opposing groups. In the context of a pandemic, an obvious place to start would be the duration of the public health emergency, as declared by the Federal Government or the State government. The problem for tenant advocates is that the acute phase of the health crisis could be declared over, while the economic damage remains. We already see state governments eager to prematurely end Coronavirus protections. It is not hard to imagine that if a state reaches 50% or higher vaccination rates then states of emergencies could be ended abruptly, even as the pandemic is still spreading — let alone the state of the economic recovery. So tying policies to the public health emergency is necessary, but not sufficient.

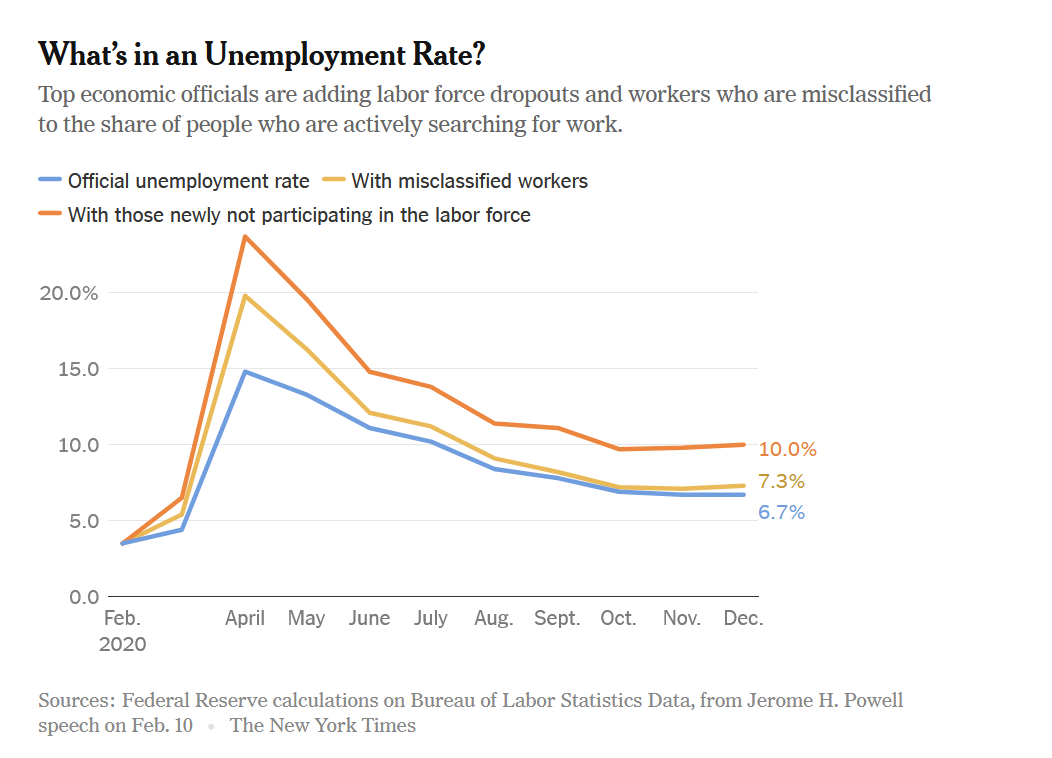

Next this leads us to the standard unemployment rate. Take the example of California’s unemployment rate below (we’ll use California as our stand-in state because the Tenants movement is particularly strong there). The advantage of using unemployment rate data is that this data is regularly updated, and it is a frequently cited measure of the labor market. While this measure of unemployment remains elevated in California, you can see how it has fallen precipitously since the peak. These measures famously don’t capture people who drop out of the labor force for recession-related reasons. They also miss misclassified workers (which is especially an issue in California).

In fact, Federal Reserve Chairman Powell recently stated that the overall unemployment rate is closer to 10% when you adjusted for these factors. (Read the New York Times coverage of this claim here.) Without the data to reproduce this “adjusted” unemployment rate at the state level in real time, unemployment statistics are not adequate to this task. Let’s flip the question though: what about employment?

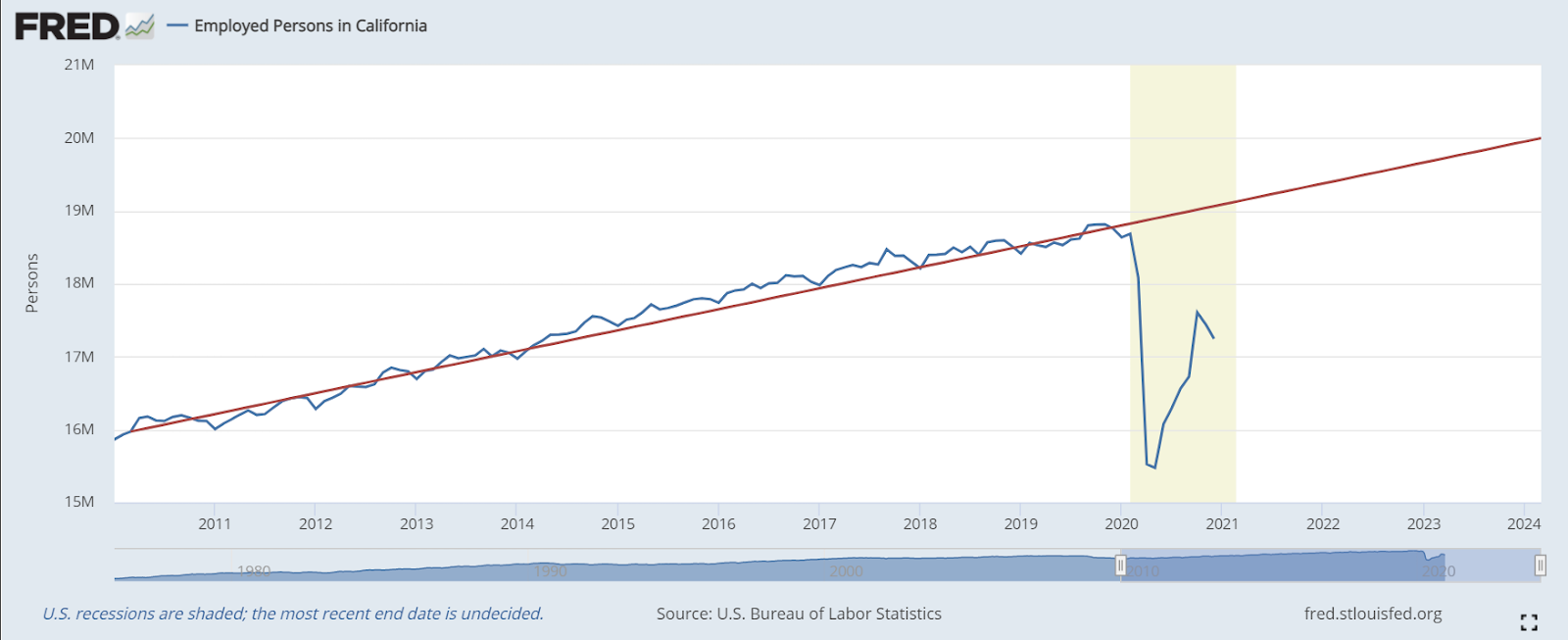

While unemployment can still be high in places where employment growth is high, this is pretty rare. More generally, employment growth itself is a good measure of the economy. We can see that clearly in the total employment in California. More than the unemployment rate, total employment in California tells us the story of how far employment fell off a cliff, and is nowhere near recovering. The red line simply tells us what (roughly) linear average employment growth would look like in California. On this (admittedly crude) measure California is missing around 1.8 million jobs.There are various ways to use this kind of data. One could use the unweighted linear trend as a kind of “job target” such that if total California employment doesn’t hit the extrapolated employment level, eviction protections remain.

You could take a 6, or even 12, month moving average of the total change of this data, and suggest a moving average target for total employment growth that must be reached before eviction protections are relaxed. You could even simply take the previous employment peak as a target that must be reached for protections to expire. California is still far away from that minimum goal at this point. The point is there many ways of using the total level of California employment — or its growth — to get a fresh measure of the labor market for such an automatic trigger.

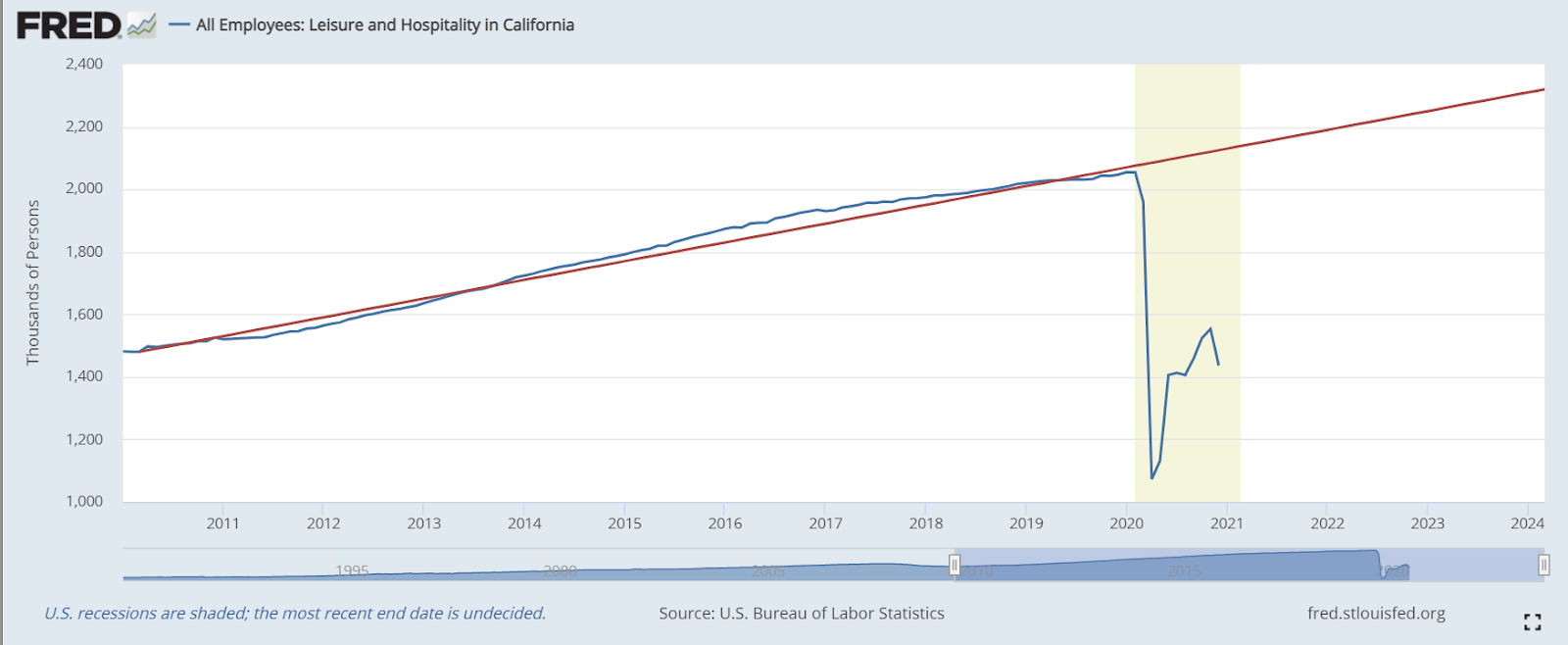

Even this measure I find unsatisfactory. Recessions don’t usually lead to evenly distributed unemployment throughout the economy. They usually hit certain sectors the hardest.

What is unique about the Coronavirus Depression is that it led to a rare “services-led recession” where services employment collapsed first and most aggressively. The service sector is the part of the economy that has been most deeply impacted. My ideal autonomous stabilizer would target some measure of the state of the labor market in services. It turns out we have a (relatively) good measure of that in the data on total employment in “Leisure and Hospitality”, which is available state by state. Here we can see how much of California’s aggregate employment losses have been driven by “Leisure and Hospitality”. By this (again crude) measure, 700,000 of those 1.8 million jobs are missing from the Leisure and Hospitality sector. That is nearly 40% of California’s overall employment losses.

Like with California’s aggregate employment data, this data could be used in absolute terms, or in growth terms. The previous peak in Leisure and Hospitality could simply be a benchmark for employment recovery before eviction restrictions are lifted. Remember that Eviction moratoriums are meant to protect the most vulnerable. While a useful measurement for economists to keep track of, aggregate job growth is no help to the person who lost a job because of the Coronavirus Depression, and can’t find another. While not perfect, aggregate measures of the hardest hit sectors tell us whether those who lost jobs in one career path have a decent shot at getting another one in the same career — and then paying the rent.

Ideally, automatic triggers would be tied to declared health emergencies. This would factor in total employment in that state, and total employment in the “Hospitality and Leisure” sector. Only once all three targets are reached could eviction protections be relaxed. While Federal policy remains gridlocked, hopefully there are at least a number of Blue states where this kind of eviction protection could be passed. California is, of course, an ideal test case here. The devastating data on its hospitality and leisure employment strongly suggests Californians absolutely need the protection.

Most importantly, while we hope to avoid pandemics in the future, it's very important to have eviction protections recur automatically in the future. Of course, we could even have another old-fashioned deep recession, where the protection would be just as necessary.

Sign up for Notes on the Crises

Currently: Comprehensive coverage of the Trump-Musk Payments Crisis of 2025