The Arthur Burns That Time Forgot: “Inflationary Psychology” and “explosive” wage rates in the 1970s

This is a premium piece of Notes on the Crises. Thank you for being a paid subscriber.

Lately, the 1970s have loomed large in economic commentary, thanks to a recurrence of panic over inflation. History is often invoked in mainstream press coverage about economic policy, which is understandable and can be helpful. But today I’m going to argue comparisons to the 1970s in contemporary journalism and punditry are mostly an example of economic history being done very badly. As soon as even the possibility of high inflation resulting from Covid related disruptions was raised, these comparisons came hard and fast.

In fact, it seems overly generous to even say that your average invocation of the 1970s is bad economic history. In other words, much of this commentary doesn’t pass for even a potted recountation of events fifty years ago. Rarely do specific decisions or contextualized events in “the 1970s” play a significant role in analysis of our contemporary moment. For too much economic commentary, the 1970s are not so much history, but a totem. Go no farther, there lies the 1970s.

One of the most frustrating aspects of this ahistorical commentary for me is the treatment of Federal Reserve Chairman and business cycle economist Arthur Burns. If all you followed was the commentary on him, you would believe he was a dopey and weak radical liberal. A hapless technocrat who nearly led this country to “financial ruin”. No one reads Burns’ own writings, references his interviews directly, or contextualizes his time as Federal Reserve Chairman. At best, you’ll get a brief reference to a speech he made after leaving the Federal Reserve called “The Anguish of Central Banking”. This is a particularly bizarre gap because Burns was Federal Reserve chairman from 1970 to 1978.

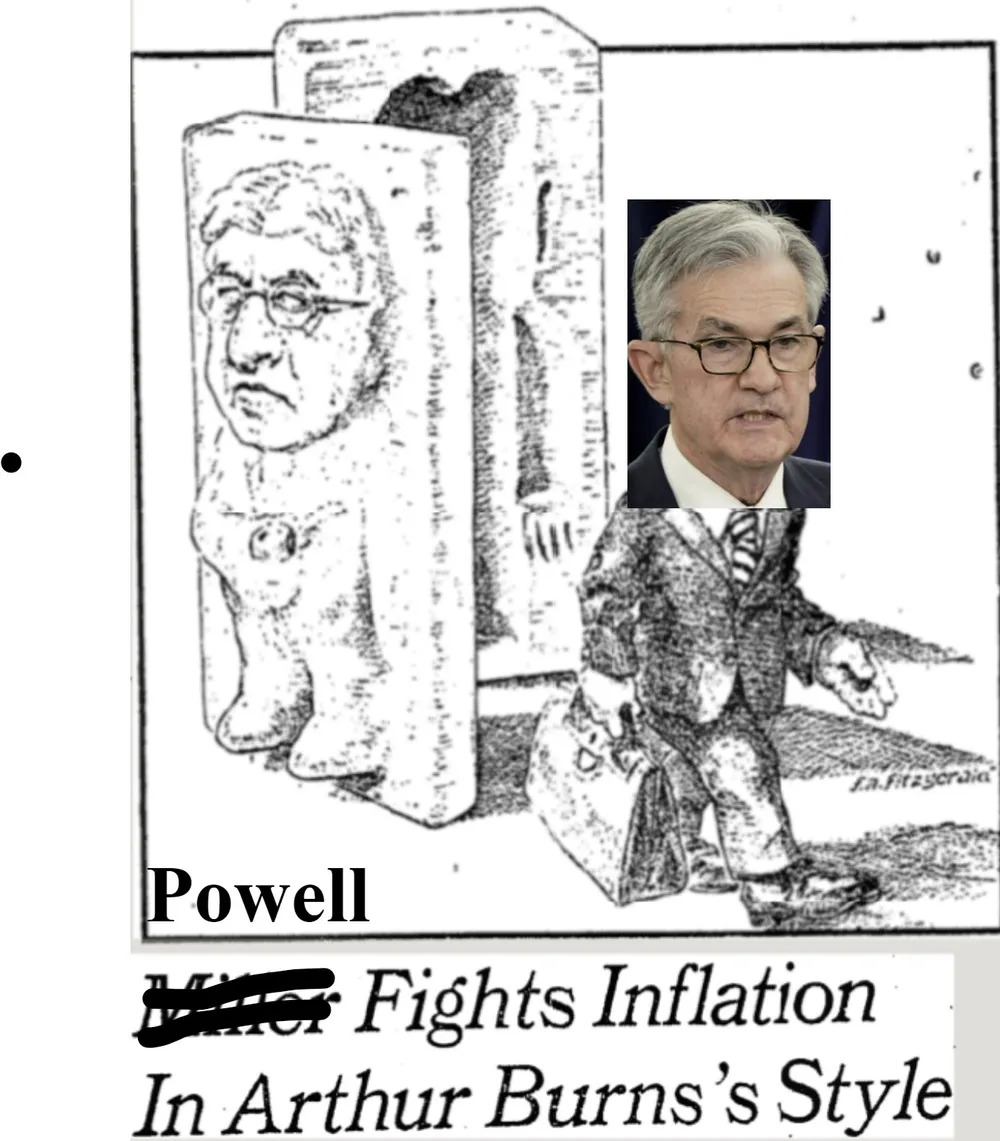

The actual Burns was- in his time- a well respected Monetary Policy “Hawk” who believed deeply in restrictive austerity. This was nearly universally acknowledged during his tenure, and then for a few years after. A New York Times article from 1978 about Burns’s successor, George Miller illustrates this well. Entitled “Miller Fights Inflation In Arthur Burns's Style”, the article argues that Miller tightened monetary policy far more aggressively than the Carter administration expected and spoke in conservative, inflation focused and austere terms. In other words, he was a clone of Arthur Burns. It would bewilder Clyde Farnsworth to know that the political cartoon attached to his article would today be interpreted as criticizing Miller for excessively loose monetary policy.

The reason this has been forgotten is the total victory of one influential dissenter: Milton Friedman. Milton Friedman, in real time, pilloried his former mentor as a money supply expanding inflationist. That view deserves its own piece sometime (spoiler: it’s mostly wrong.) But for now what’s important is that while Volcker is later seen as validating Friedman, that didn’t satisfy the great monetarist himself. Instead, Friedman complained about Volcker’s “failure” to control the money supply. Without the supposed money supply-inflation link, his claims about Burns become a lot more suspect. Nonetheless, they are unquestioned history…Even among people who don’t consider themselves monetarists.

Of course, policymakers today are not monetarists either. They are not trying out controlling the money supply (as Sheila Bair pointed out) — nor are they even claiming to. Instead they are aggressively hiking interest rates to attempt to weaken the labor market, and lower wage rate growth. They are doing this because they think “in the long run”, faster wage rate growth is the cause of higher inflation. As chairman Powell said at a recent Brookings Institution event: “To be clear, strong wage growth is a good thing, but for wage growth to be sustainable, it needs to be consistent with 2% inflation”.

Burns talked in these exact same terms about wage growth: “To the extent that wage increases outrun gains in productivity, business costs— and ultimately consumer prices— are driven up”. In fact, even the same accounting identity relating productivity, wage growth and inflation led to the 2%-3% “inflation target” of Nixon’s wage and price controls (that’s a topic I will return to later). He was obsessed with wage growth, and saw its “explosive” form as the core threat to price stability — just as Powell’s Fed does today. This is certainly not an area where you could find a dime’s worth of difference between Powell and Burns.

One part of the fantasy Arthur Burns which has been added by pundits in recent years is that he is alleged to not take “inflation expectations” seriously. Supposedly, along with most policymakers or experts in the early 1970s, Burns just didn’t consider inflation a high priority. According to this account, Burns didn’t preemptively tighten monetary policy because he simply didn’t understand the importance of getting inflation expectations under control. Today's enlightened policymakers understand that, which is why policy is so much “better” today. Hooray for progress!

Except, this narrative is… questionable, to say the least.

In fact, my main motivation for writing this piece came from how bizarre this narrative is, when compared to reading literally any of Arthur Burns actual writings and speeches. There are few people in the history of economic thought who have obsessed more over the expectations of businessmen and households than Arthur Burns. His late 1960s and early 1970s commentary is shot through with a deep, perhaps even obsessive, focus on “inflationary psychology”. True he rarely used the phrase “inflation expectations” (if at all). But there’s more than one way to refer to an important topic, and the economic meaning in his writing is identical. To take an example, almost from random, from congressional testimony in November 1971:

In part, the cost pressures stemmed from efforts by workers and their trade unions to compensate for the eroding impact of past price increases on their real earnings. But they also reflected the efforts of labor to anticipate future price increases. Both labor and management came to expect that inflation would persist, and that it might become our way of life. In this environment, labor typically demanded large wage increases, and business firms typically met these demands in the belief that higher costs could be passed on in the form of higher prices. As the pace of inflation quickened, expectations of continuing inflation began to dominate economic decision making”

This is no isolated example. His commentary is filled with passages like this, showing inflation expectations to be a sustained concern of his thinking. Claiming Arthur Burns didn’t focus on inflation expectations is the intellectual equivalent of saying Milton Friedman didn’t focus on the money supply.

So how did the Burns era actually differ from Jerome Powell’s Federal Reserve? One is intellectual, the other historical.

Intellectually, Burns didn’t think restrictive monetary policy was enough to control inflation expectations. One reason was that he thought that fiscal policy and non-financial regulation had much bigger impacts on inflation expectations than monetary policy. And certainly was more relevant to the stated plans (forward guidance) of monetary policy. The latest evidence tells us he was right about that.

Burns also emphasized that “inflationary psychology” had counteracting effects in that higher and more uncertain inflation expectations. Expectations of higher inflation are also commonly associated with a declining economic outlook, which can discourage spending (and wage demands). As economics writer Joey Politano pointed out, this is also something suggested by the best evidence we have today. Most critically though, he thought that the collective bargaining decisions of labor unions were insensitive to overall economic conditions.

Which brings us to the historical difference between the early 1970s and today: Unions. The number of unionized private sector employees relative to total private sector employment was far higher then. Union density has fallen dramatically since Burns’s career. In fact, it's close to dead today. In 1970 private sector union density was 29.1%. In 2019 it was 6.2%. Even these incredible numbers understate the story. Unions at that time had strong influence over their employers and economic (and legal) conditions required treating them as an important, and feared, stakeholder in many sectors throughout the economy.

Even a matter of years later, both economic and legal conditions had changed. That union density had fallen to 20.1% by 1980 and the legal environment on everything from unemployment insurance, Aid to Families with Dependent Children (AFDC), to the NLRB and deregulation had changed. Even state policies that had been generous in the late 1960s to early 1970s were radically rolled back. Perhaps most importantly, unions in goods producing industries became subject to far more international economic pressure and coercion than they had in earlier decades. By any possible measure unions (in general) have less leverage over the average employer today. That’s actually true even in many circumstances when they make up a large proportion of an employer’s employees.

The point is that the role of labor unions in the wider economy was far different at the beginning of the 1970s and Burns conceptually understood that it was different. In these circumstances Burns thought controlling inflation required direct intervention in the collective bargaining process. That wasn’t a liberal orthodoxy: he was thinking like businessmen, economists and most policymakers of his day. In fact, while it seems far fetched today, wage and price controls were a common business proposal at the beginning of the 1970s. Monetarist Historian and former Richmond Federal Reserve economist Robert Hetzel lays this out clearly in an oral interview with legendary private sector economist Albert Wojnilower:

Robert L. Hetzel: Well, at that time, it was—well, for example, in 1970, Robert Rosa gave a speech at the whatever the finance association is, and he argued for a six-month wage freeze to change psychology. And that’s what people like Volcker and Weidenbaum, who is a very conservative person, that was the common view; that there was an inflation mentality that had to be stopped, and the way to stop the psychology was for freeze for six months. [...] Burns, ever since he was head of the NBER, sat on a lot of corporate boards. Like Greenspan, he would sort of be a business forecaster. I think it was a lucrative thing for him. And he always thought he had an insight into the psychology of the businessman, and a lot of his ideas really reflect to the conventional views of the business community at the time. And I think that’s where they came from, because the business community was very much in favor of controls. When they said “controls,” they mean wage controls and price controls

Albert Wojnilower: Absolutely. You’ve got that totally right. And it was a great irony at that time that the business community were the ones who pushed this idea, which I suspect a lot of researchers or people who talk about this history, would like to overlook when they talk about it.

What that means is that conventional wisdom appears completely backwards. Rather than ignoring inflation expectations, the obsession with inflation expectations led Burns and other policymakers to use a tool of non-financial regulation to directly stabilize wages and prices. They did that in order to reduce inflation expectations, and thus inflation. They were clearly egged on by both the business community and even the labor movement (which had long endorsed price controls).

Given the international experience with stabilizing wages in highly unionized economies, and the fact that the Volcker shock only “succeeded” in a rapidly deunionizing and already changing economic and legal environment, modern conventional wisdom appears extremely suspect. The idea that Chairman Burns could or should have “just done a Volcker” falls apart under even minimal examination. Economic, political and legal conditions were totally different at the beginning of the 1970s than at the end. Burns had no choice but to try to find a path to full employment and lower measured inflation within the constraint of a much more unionized and formidable private labor force. Indeed, one way of understanding the political shift rightwards during the 1970s is as a response by political elites and businessmen to having to make decisions with consideration of labor union power under more adverse economic conditions. All of this is true and I have not even touched on the financial stability concerns which reinforced Burns’s decision to take a self-described “middle path” on restricting aggregate demand.

Of course, wage and price controls didn’t succeed to stabilize inflation. I wrote about this topic over the summer. But in the context of Arthur Burns, my argument in that piece takes on new light. The obsession with inflation expectations which Burns shares with Powell points us in the wrong direction. Wage and price controls did get inflation expectations under control. Cost of Living Adjustments (COLAs) in collective bargaining contracts collapsed. Prices nonetheless shot up as soon as decontrol set in. Inflation expectations weren’t determinative of actual price increases. Pricing power, rather than price expectations, were what mattered then. And they’re what still matter now.

(For more on the actual experience of administering wage and price controls, check out my interview with the chief economist of Nixon’s Pay Board Daniel Mitchell.)

Which leads to the other problem with both Chairman Arthur Burns and Chairman Jerome Powell. Their obsession with wages. The chief example of “explosive wage growth” to Burns and his business interlocutors was the growth in construction wages. In fact, they were so alarmed by them that Nixon implemented construction union specific wage controls in March 1972, five months before general wage and price controls. Price controls themselves were only proposed because it was believed unions would not accept wage controls without price controls. Meanwhile today even prominent Federal Reserve official Lael Brainard is bringing up the role of profit margins. That implies the potential (though not guaranteed) role of pricing power in inflation today.

If Powell is wrong, then corporate pricing power (or even simply pricing power in housing and a smattering of other “regulated industry” sectors) can sustain above target inflation. That means even if wages forcefully decelerate, we will see severe problems. Most likely, it would mean a doubling down on restrictive monetary policy into already worsening economic conditions.

Ultimately Powell may succeed where Burns failed. But it will be an accident. Powell is operating with the same playbook that Burns was… He just doesn’t have to read the chapters related to a heavily unionized labor market. Most troubling though is that Federal Reserve officials still talk as if workers have lots of bargaining power. As my guest Daniel Mitchell wrote in a paper entitled “Not Yet Dead at the Fed”, Federal Reserve transcripts are filled with labor bargaining language, despite the lack of private sector unions. Even when you consider all the pandemic disruptions, this has made the Federal Reserve’s job a lot easier than the job Arthur Burns’ Federal Reserve had. Jerome Powell is acting like an Arthur Burns clone- that just makes him a monetary policy hawk, not a dove.

In short, read more Arthur Burns, and less “whig” history.

Subscribe to Notes on the Crises

Get the latest pieces delivered right to your inbox