If you are a current or former career “civil service” Treasury or Federal Reserve System employee, including in the general counsel’s offices of either entity, and you have detailed knowledge of how the Bureau of Fiscal Service operates at an operational level please

This is a free piece of Notes on the Crises. Reader support which makes my Freedom of Information Act project, archival research and general writing possible (including my #MonetaryPolicy201 series). Monday is the last day paid subscriptions are 50% off so take advantage while

#MonetaryPolicy201 is a monthly series about the basics of monetary policy. It’s a “201” series because I will be grounding the basics of monetary policy on their largely forgotten legal foundations. The beginning of this series will focus on various aspects of the

Please recommend an institutional subscription to your academic library or employer (details here)

The debt ceiling was unsuspended January 1st of this year which means the debt ceiling is back. According to now-former Treasury secretary Janet Yellen, they began using “extraordinary measures” to avoid

#MonetaryPolicy201 is a monthly series about the basics of monetary policy. It’s a “201” series because I will be grounding the basics of monetary policy on their largely forgotten legal foundations. The beginning of this series will focus on various aspects of the

Pavlos Roufos is a Greek political economist living in Berlin. He has a PhD in political science from Kassel University. He works on central banks, constitutional law and European integration from the 1920s to today, with a special emphasis on the Eurozone crisis. You

Over the years I’ve gotten inquiries about taking on institutional subscriptions. Those requests have come from both academics and employees at for-profit businesses- Institutional subscriptions mean that a firm or a library would sign up on behalf of their employees, students or simply

Announcement: I'm putting on an end of year sale. For just 55 dollars a year you can subscribe and receive premium pieces of Notes on the Crises. This also helps support the FOIA efforts I've been engaging- like the 30,

For the past year and a half I’ve increasingly focused on using FOIA to scrutinize the Federal Reserve. Before I unveil the crown jewel of what I’ve accomplished so far, I think it's worth stepping back and saying why I’ve undertaken such a broad project.

Perhaps the most shocking thing I have come across in the minutes is that the Federal Reserve very nearly got rid of its own emergency powers.

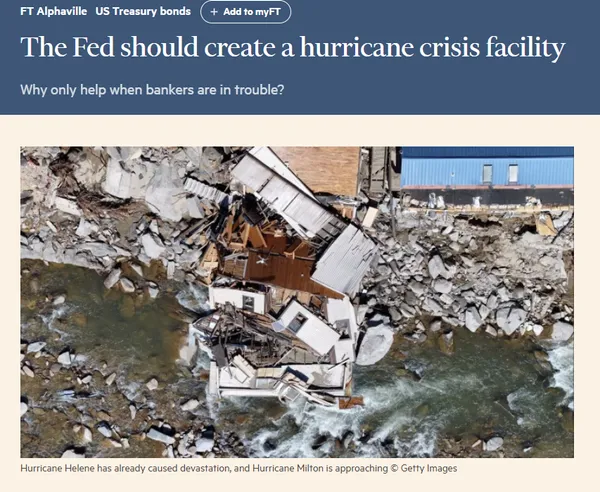

The Federal Reserve should create a Hurricane crisis facility. Massive hurricanes are "unusual and exigent circumstances" and should be treated as such.

An update on my major project of the moment: launching my 30,000 page database of FOIA minutes. All of the minutes have been uploaded to my website, but generating an accessible and searchable database of these pdf files has taken significantly longer than