Perhaps the most shocking thing I have come across in the minutes is that the Federal Reserve very nearly got rid of its own emergency powers.

An update on my major project of the moment: launching my 30,000 page database of FOIA minutes. All of the minutes have been uploaded to my website, but generating an accessible and

Subscribe

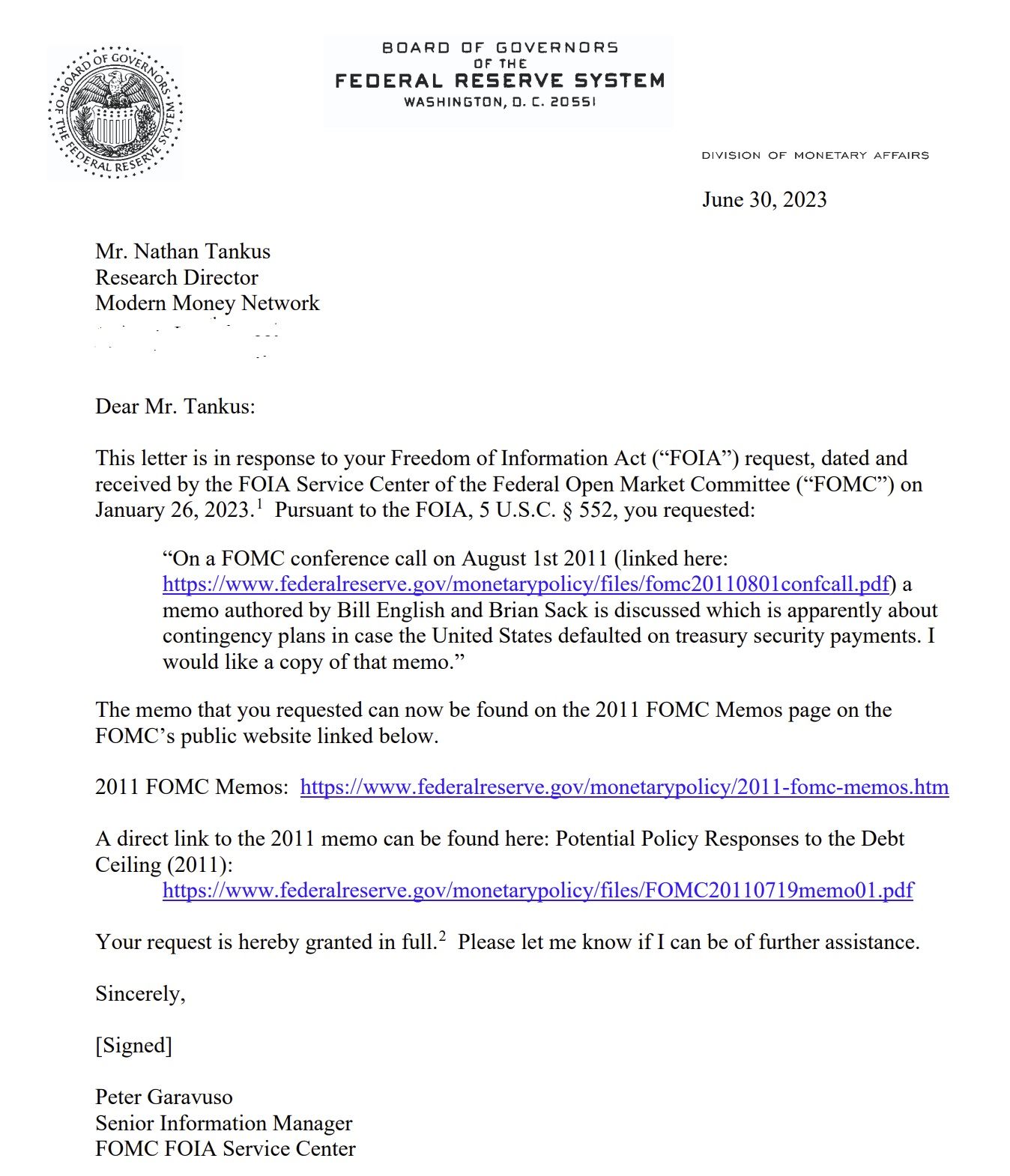

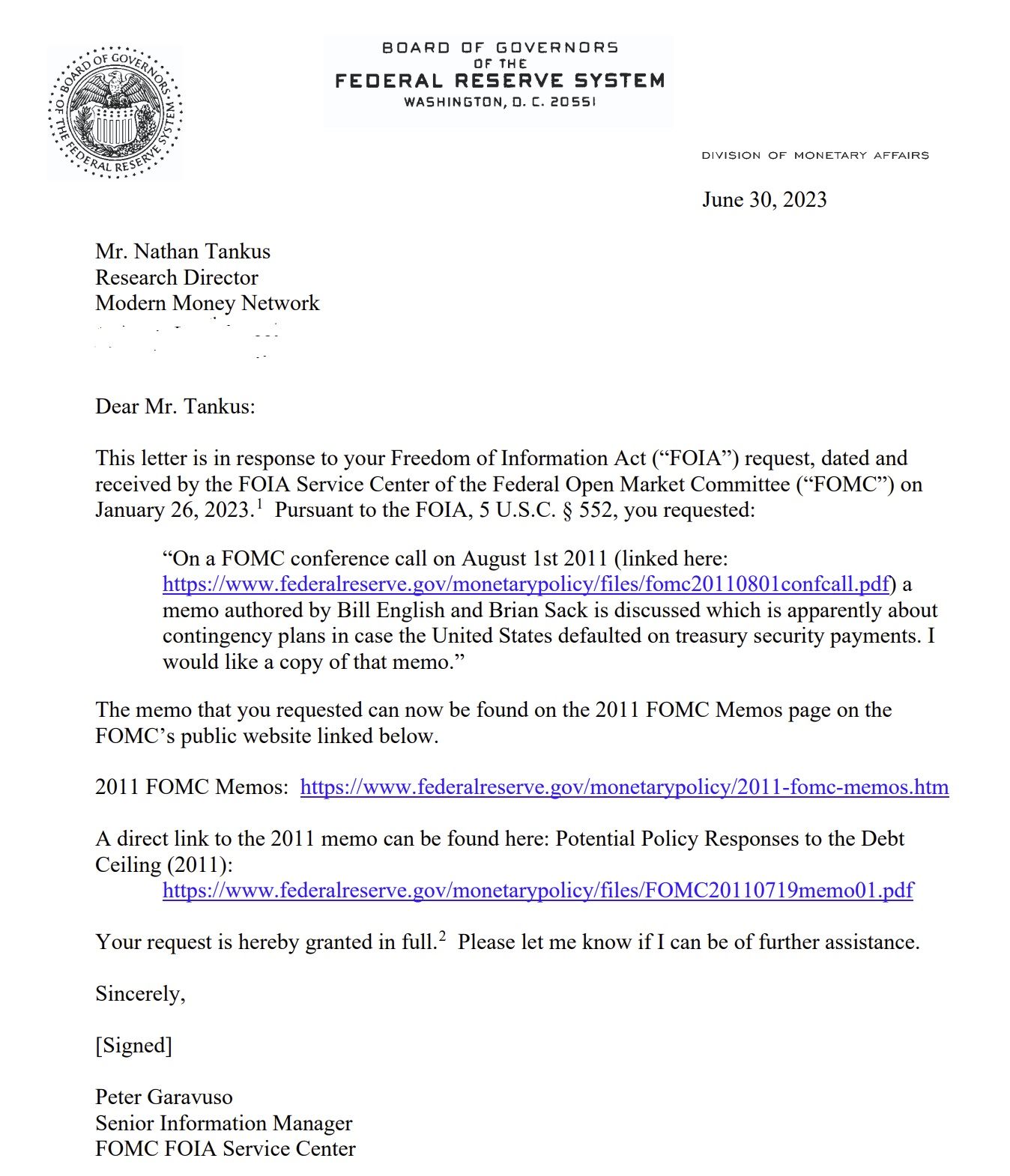

Readers may recall that I wrote a Politico Op Ed at a critical moment in the debt ceiling showdown. That piece, was entitled “Biden Can Steamroll Republicans on the Debt Ceiling”, and

Subscribe

On March 16th 2023, the Thursday after Silicon Valley Bank Failed, I published a piece entitled “What's going on with Treasuries? Silicon Valley Bank and the incoherence of the Federal

.

Before Silicon Valley Bank failed last week, I was considering writing a post examining the Federal Reserve’s policy framework in the context of the last sixty years of monetary policy’s history.

Normally I do not release pieces on Saturdays or Sundays. However, this is the third anniversary of the first piece I ever sent of this newsletter. That brief note, appropriately titled “Sign of

Financial crisis nerds have had quite a weekend. In short order the one-of-a-kind Silicon Valley Bank began to reportedly be experiencing losses, and large uninsured depositors began loudly and aggressively “pulling” their deposits.