Payment Systems: Monetary Policy 101

A Shtetl Parable of IOUs About Town

#MonetaryPolicy101 is a weekly series about the basics of monetary policy. This is the third Post. See Post 1 here and Post 2 here. If you like this series please consider taking out a paid subscription here. It is reader support which sustains my ability to treat this substack as a full time job.

"Money is what payment systems do"- Joseph Sommer, Legal Counsel to the Federal Reserve Bank of New York

Macroeconomics is a notoriously difficult topic. People really have trouble understanding these concepts. I think part of the reason is we generally know very little about payments systems and how they work. Nor is macroeconomics education built up from a foundation of balance sheets and payments systems. Payments are the raw materials of economics, especially monetary economics. If we built up from this foundation, maybe these big concepts would be more understandable. In this context it is interesting to me that this polish economist used the following parable to try to explain macroeconomics to a member of Poland’s military junta in 1935:

In an impoverished Jewish shtetl in Eastern Poland, whose residents were mired in debt and living on credit, a wealthy and pious Jew arrived one day and checked into the local inn, taking care to pay his hotel bill in advance. On Friday, to avoid breaking the Sabbath injunction against carrying money, he handed over to the inn-keeper for safe-keeping a $100 note. Early on Sunday, the wealthy and pious Jew left the inn before the inn-keeper had had a chance to return the banknote.

After a few days, the inn-keeper decided that the wealthy Jew was not going to return. So he took the $100 note and used it to clear his debt with the local butcher. The butcher was delighted and gave the note for safe-keeping to his wife. She used it to clear her debts with a local seamstress who made up dresses for her. The seamstress was delighted, and took the money to repay her rent arrears with her landlord. The landlord was pleased to get his rent at last and gave the money to pay his mistress, who had been giving him her favours without any return for far too long. The mistress was pleased because she could now use the note to clear off her debt at the local inn where she occasionally rented rooms

So it was that the bank-note finally returned to the inn-keeper. Although no new trade or production had occurred, nor any income been created, the debts in the shtetl had been cleared, and everyone looked forward to the future with renewed optimism

A couple of weeks later, the wealthy and pious Jew returned to the inn, and the inn-keeper was able to return to him his $100 note. To his amazement and dismay, the wealthy Jew took the note, set fire to it, and used it to light his cigarette. On seeing the inn-keeper’s dismay the wealthy Jew laughed and told him that the banknote was forged anyway.

Economist Jan Toporowski recounts what the junta member’s response to the story was:

Landau finished his story and waited for understanding to seize the colonel. Beads of sweat appeared on the colonel’s forehead, from the intellectual effort at comprehension. Finally, as if he had stumbled on the explanation, the colonel exclaimed: ‘Ah, I knew from the very beginning that there was something wrong with that Jew. Of course, the money was forged!’

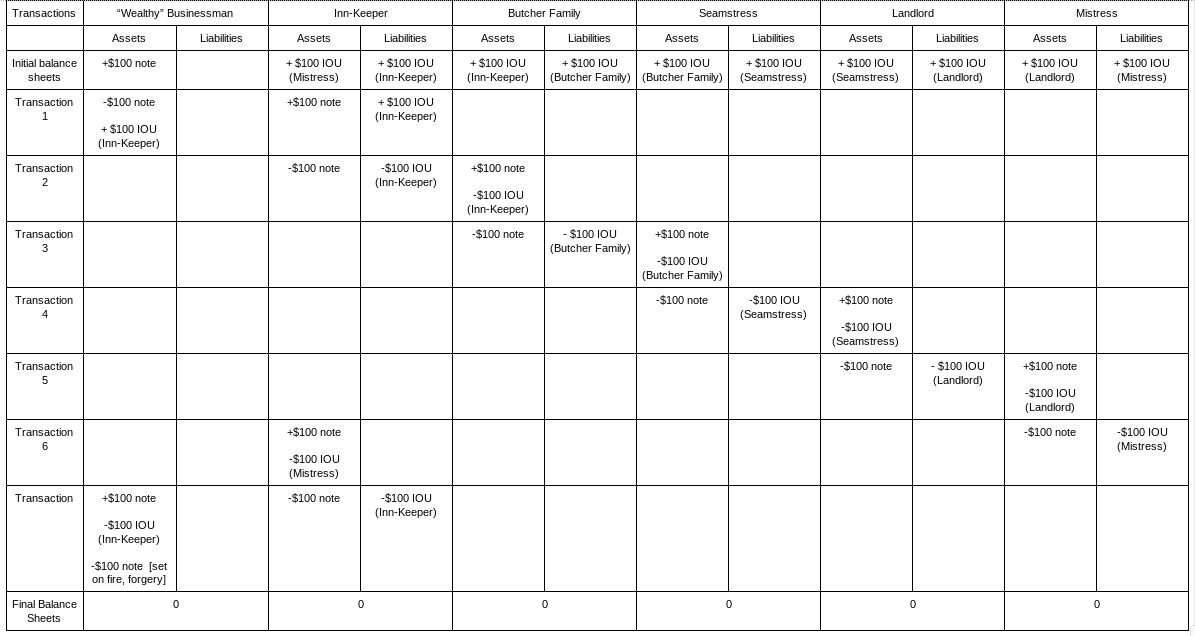

In other words, he completely missed the point. As an aside, it seems likely this parable was inspired by the 1931 Weimar German film “The Trunks of Mr. O.F.”. Anyway, what’s interesting about this example is that it isn’t about production. It’s not really about income at all. It’s about debts and the inherent interrelatedness of balance sheets. At the most fundamental level, it's about payment systems. To start grasping the nature of payment systems, it’s worth following the transactions in this deceptively simple little parable. Spend some time looking at the mammoth set of interrelated T accounts below.

A capitalist economy can be described by a set of interrelated balance sheets and income statements.- Hyman Minsky

If you study The table above closely, what you’ll notice is that no one (outside the putatively wealthy businessman) is a net creditor. Each one owns an IOU that is of equal value to their own debt. What they need is some mechanism to get their creditors to accept their debts at 100% “on the dollar”. The forged note serves as that device. It is here where many other writers would write about the “faith-based” nature of money. I will not. The forged note is a fraud. It is representing itself as a financial instrument with a specified and predictable legal value- physical currency which can be used to pay taxes or court-ordered monetary payments.

What the shtetl needs is to increase the “moneyness” of their IOUs by gaining the legal right to settle payments with them. The problem with the current system is it is a set of bilateral (two way) debts with limited transferability and usage possibilities for each IOU. In other words, the payment system in this little town is diffuse, fragmented and unreliable. Of course, this type of system isn’t simply a free ride. In small communities with bilateral, informal payments you can be sure to be ridiculed if you don’t return the favor. The trouble is that these enforcement mechanisms are grounded in local knowledge and have very little in the way of formal third party enforcement or use beyond the local area. If money is indeed “what a payment system does” then making IOUs more widely acceptable, more easily transferred and payment processing faster is in a very literal sense improving and streamlining money itself. Next week we’ll expand our purview to banks, but for today we’re going to start with an entity called a “clearinghouse”.

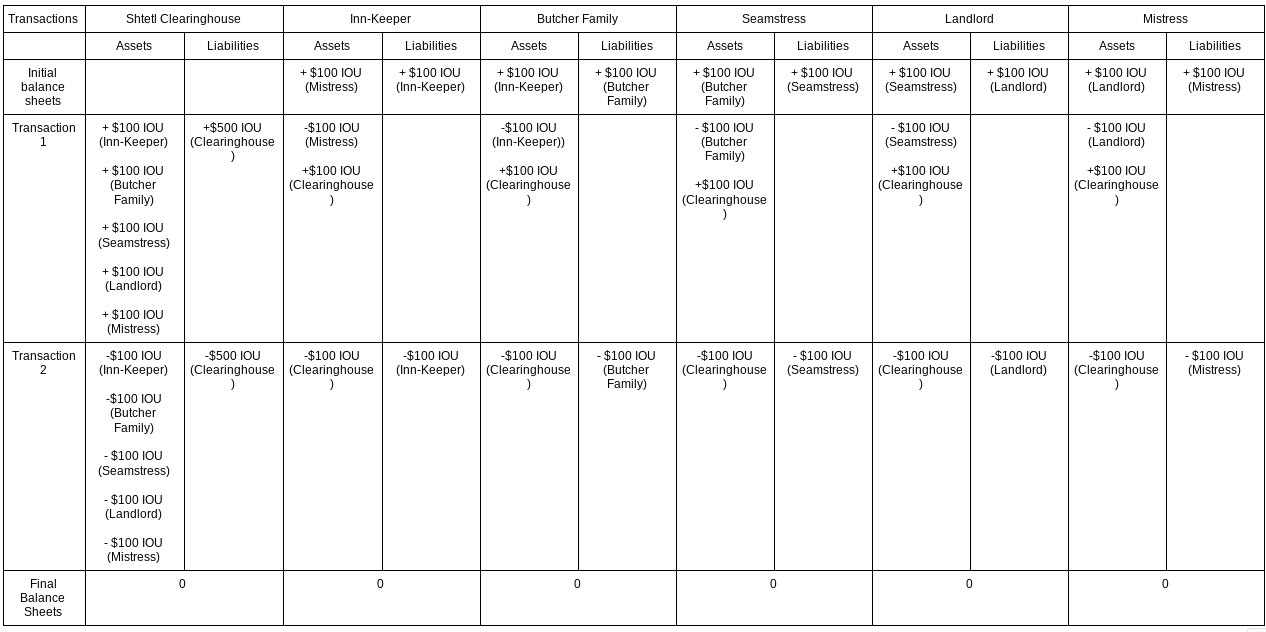

What the shtetl needs is a clearinghouse. A clearinghouse is an entity that stands between buyers, sellers or financial institutions as they route payments to each other. What a clearinghouse allows for is the settlement of payments without the transfer of some settlement asset. If you look at the example above, every resident of the shtetl has made 5 purchases by proffering their own IOU and then paid off that IOU with a note. Each transaction is ultimately “settled”, as in closed finally, with cash. Why should every payment require cash when you have this interrelated set of debts? Below, we’ll see just how simple this could be if each resident of the shtetl became members of a clearinghouse by transferring their assets (and thus other resident’s debts) to the clearinghouse in exchange for clearinghouse certificates.

Because every resident is a member and has no financial net worth, joining up allows them all to clear their debts with each other. In this example, there are five IOUs that come out of an everyday transaction but none are settled in “cash”. This is the genius behind clearing payments and why payment systems are so important. The ability to “clear payments” and only settle net amounts in “cash” greatly facilitates the ability to make payments. In very real ways, it’s why the modern financial system survives. Of course, the flipside of the ability to avoid cash transactions is taking on credit uncertainty. Owning a chunk of a clearinghouse that will take losses if your former debtor defaults is certainly less risky than owning the debt outright, but it's still a risk. Clearinghouses regularly ask counterparties to post collateral- which brings us to last week’s post. Cash settlement avoids these tangled issues of counterparty uncertainty and collateral. Balancing these two elements is an essential feature of modern money design.

Of course, the other thing this parable illustrates is how important it is for households and businesses to, as a whole, be able to make payments or, failing that, freeze their payments. A payments holiday is kind of like a forced clearinghouse membership except net debtors benefit while net creditors lose. In the above example, no one was being charged interest. Interest very quickly polarizes financial positions between debtors and creditors. What we’ll also learn is that being a bank is rarely about being a net creditor but, instead, about a “spread” between the return on their assets versus the interest they pay on their debts. For the foreseeable future I think I will be writing more #MonetaryPolicy101 posts about payment systems as I think there’s a lot more to say. Next week’s post will be about payment systems and banks.

Subscribe to Notes on the Crises

Get the latest pieces delivered right to your inbox