I'm turning Notes on the Crises into a full-fledged publication

Subscribe to help me do that

Subscribe to help me do that

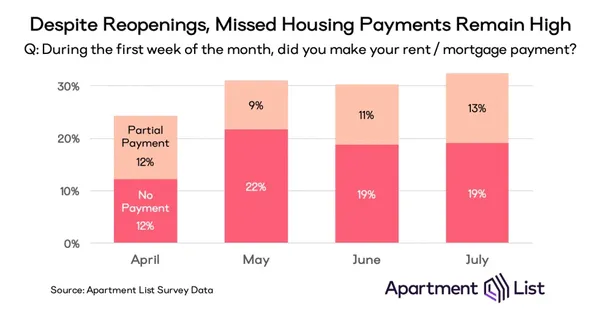

On Thursday [https://www.crisesnotes.com/congress-is-a-month-away-from-cutting/] I wrote about how congress needs to extend Federal Pandemic Unemployment Compensation (FPUC) or millions of households in the United States would be facing desperate crises. If anything, I understated how dire circumstances are. Millions of U.

> THREAD: I've decided to hold off my post on evictions to tomorrow morning so in the mean time I'm going to link to some posts that I think new readers may be interested. First up, we should suspend dividend

This Can’t Be Allowed To Happen

Thank You for Your Very Generous Support

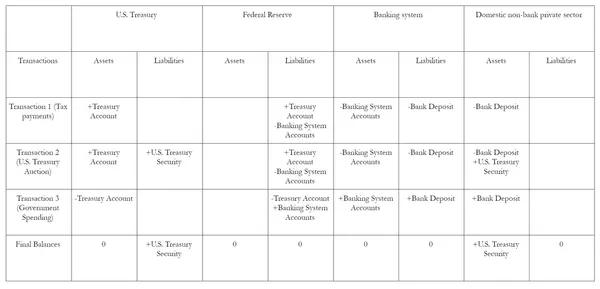

On this substack I rely on Modern Monetary Theory (among other bodies of knowledge) to inform my analysis. Yet, I rarely explicitly write about MMT (for my own introduction to MMT and an overview of what it has to say about the current crisis,

My Modern Money Network Colleague’s take on Facebook’s Proposed Global Currency

Analyzing Proposals from Timothy Geithner, Jason Furman and … Glenn Hubbard

> Hello, @nathantankus [https://twitter.com/NathanTankus?ref_src=twsrc%5Etfw]. A few people have emailed me about your response to my article for @TheAtlantic [https://twitter.com/TheAtlantic?ref_src=twsrc%5Etfw], so I thought I’d respond in a thread here. First,

A Reply to Frank Partnoy’s Atlantic Feature Article

I’m taking a posting break in light of recent events

Here's My Written Remarks.