What if The Federal Reserve Just ... Spent Money?

... could it?

There are many proposals circulating for how to deal with this crisis which each deserve separate analysis. However, I want to cover an audacious and straight forward idea that I’ve half-jokingly batted around for years. That is, what if the Federal Reserve just… spent money?

The Federal Reserve of course has made some extraordinary interventions over the past week, including a program announced yesterday of questionable legality which finances a special purpose vehicle (basically a custom corporation to function as a “passthrough entity” so that actors can do what they want to do that they wouldn’t legally be able to otherwise) to purchase “investment grade” corporate bonds and exchange traded funds. This Special Purpose Vehicle has been capitalized by the Treasury so that it can withstand 30 billion in losses. I will be analyzing that proposal and what it means in more detail tomorrow. Despite these extraordinary interventions, their basic problem remains- they are not spending. They don’t generate income for the private sector which is what the private sector desperately needs. Forgiving these loans after the fact only generates disposable income years later, not now. Income for the private sector is a matter of fiscal policy, not monetary policy.

But what if the Federal Reserve conducted fiscal policy? In other words, what if it just spent money? This proposal is so mind-bendingly simple it repels our mind, much like how deceptively simple money creation itself is. The key here is that the Federal Reserve is not subject to congressional appropriations. It determines how large its operational budget should be and what it should be spent on. As law professor Peter Conti-Brown says in his book “The Power and Independence of the Federal Reserve”:

The bottom line is this; when Congress Removed the Fed from the annual appropriations process, as it has done with several agencies throughout history, it also imposed strict, statutory limits on how the Fed could generate these nonappropriated funds. One by one, those limits have disappeared, but not through legislative annulment. Time and changing circumstances have intervened. The law of the Fed's limited budgetary autonomy remains on the books; the practice of the Fed's unlimited budgetary autonomy is very different [...] The Fed thus has the ability to create from nothing the money it eventually uses to pay its employees, fund its conferences, and renovate its buildings

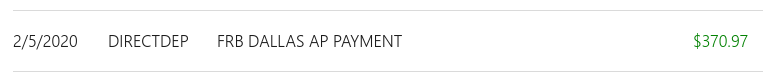

I’ve in fact seen this first hand and been a beneficiary of Federal Reserve fiscal policy. Last December I attended a day long conference at the Federal Reserve Bank of Saint Louis on fiscal and monetary policy coordination where my hotel was paid for by the Federal Reserve while my flight and transportation was reimbursed by them (I don’t know why the payment was ultimately made by the Dallas regional bank)

If the Federal Reserve can decide to give me money to attend a conference, why can’t it make other discretionary fiscal policy choices? If we must keep up the pretense of conferences, why not pay millions of Americans to attend daily teleconferences where they learn what the Federal Reserve does and discuss what this country should do with its physical resources moving forward? Or maybe conduct a “randomized control trial” where you pay every person an income and you randomly decide who gets tasks or not and measure outcomes.

Hell, let’s conduct an experiment where the Federal Reserve guarantees healthcare to every resident of the United States. This may be audacious, large and egregiously flout the spirit of congressional decision making but so do many other Federal Reserve actions done under emergencies. If congress wants to countermand the Federal Reserve, make them pass a bill limiting the Federal Reserve’s fiscal policy discretion (which should be limited) but authorize an “on balance sheet” rescue package as generous as the one the Federal Reserve was planning on conducting.

Ironically, I’m sending this out just as Joe Weisenthal (who’s Bloomberg TV Show I happen to be doing this afternoon to discuss fiscal automatic stabilizers) posted about how the Fed’s normal suite of operations doesn’t generate income (and financial net-worth) for the private sector and thus the memes are wrong. In normal times what Joe is saying would basically be true- congress would freak out if the Federal Reserve started spending hundreds of billions or even trillions of dollar- but these aren’t normal times and all options should be considered on the table. It’s really a norm, a careful political stalemate with congress that keeps the Federal Reserve from conducting large-scale fiscal policy, not any specific law.

Ultimately, I would greatly prefer that congress act adequately and quickly to this crisis. I think the use of legislative power to respond to our actual problems is important and key to taking the first step towards rebuilding democracy and a democratic culture in the United States. However, it is hard to make the case that if (or when…) congress fails to act, the Federal Reserve shouldn’t step in to provide the income the economy desperately needs. Unlike with certain debt purchases and lending programs, there is no statutory limitation on the Federal Reserve’s operational budget. I may worry about what it means democratically in the long run, but at this point we don’t have time for that.

Subscribe to Notes on the Crises

Get the latest pieces delivered right to your inbox