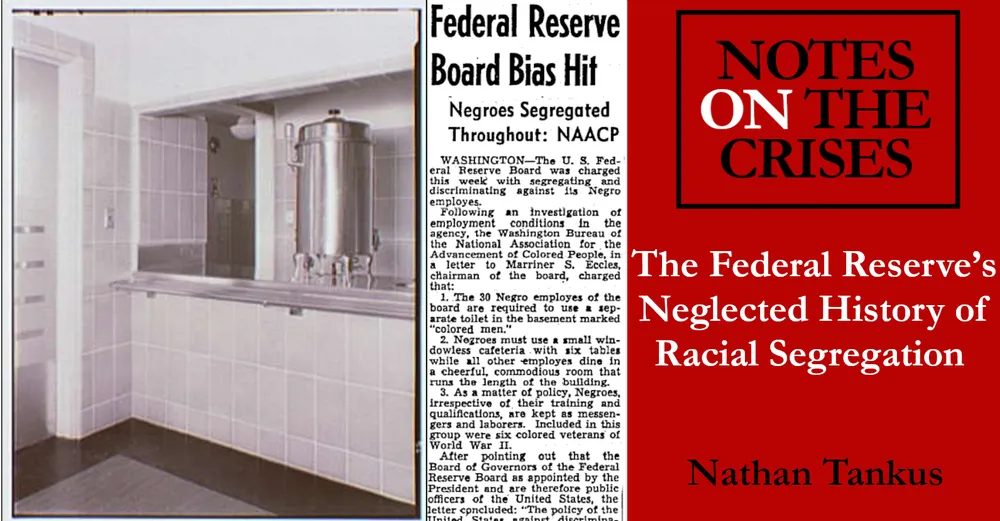

The Federal Reserve’s Neglected History of Racial segregation

Recent events regarding Lisa Cook’s attempted firing by Donald Trump have convinced me to do a premium series on the history of racial segregation and the Federal Reserve. This is for a few reasons. First, I think it's difficult to understand the import of this moment without understanding the history of racial segregation in the Federal Government and in the Federal Reserve System, specifically. Indeed this history hasn’t really ever gotten a serious treatment. This is for a variety of reasons which are beyond the scope of this piece to examine.

Second, I think this history is a good opportunity to discuss a topic too smothered in demagoguery in mainstream discussions: Diversity, Equity and Inclusion (“DEI”). This topic matters because the federal government offices which have recently used this terminology date not from 2015 but 1965. Indeed, this theme is one I wanted to pick up from the first time I heard from sources within the Bureau of Fiscal service. When I asked BFS sources whether people were being fired in early February, they told me “The only outright firings were of the Economic Equality and Opportunity team which one source found ‘insanely concerning’ since that desegregation and anti-discrimination office has been in every federal agency since 1965.”

It should be informative that those employees were first on the second Trump administration’s chopping block. The Equal Employment Opportunity Commission (EEOC) was one of the first agencies where Trump fired multiple commissioners, depriving the Commission the “quorum” it needs to function. The recency of the acronym “DEI” has obscured that the Trump administration’s promise to “eliminate” DEI was in practice a promise to eliminate federal government protections against discrimination and racial segregation. To those unfamiliar with the history of racial discrimination protections, that may seem like an extreme claim. In context however, it is not.

Third, I happen to know quite a lot about this topic because it was going to be one of my biggest focal points in my book on the Federal Reserve Picking Losers. At the time the Trump Musk Payments Crisis broke out, I decided to reformulate my book around this crisis. I have done so, but I can’t talk about it in more specifics at this time. This, however, leaves an enormous amount of research on the “cutting room floor” and a premium series at Notes on the Crises lets me put this material to use while leaving myself the option of picking up these themes in future books.

I know a number of my readers will find this topic uninteresting, counterproductive or worse. To those readers I say that there are important things you miss about even the most humdrum economic topics when you ignore this issue. Furthermore, I will continue to provide the technical economic analysis you are “more” interested in in other writing. Nevertheless, you might gain more out of this series than you may expect, so give it a chance.

Sign up for Notes on the Crises

Currently: Comprehensive coverage of the Trump-Musk Payments Crisis of 2025