Tomorrow is my 34th Birthday and as such this month's "Birthday" sale is still ongoing. Take advantage today!

Birthday Sale!

Longtime Notes on the Crises readers will remember that

Buy a Paid Subscription

The developments in the legal fight between the Federal Reserve Governor Lisa Cook and the second Trump administration have evolved quite rapidly over the past three weeks. It'

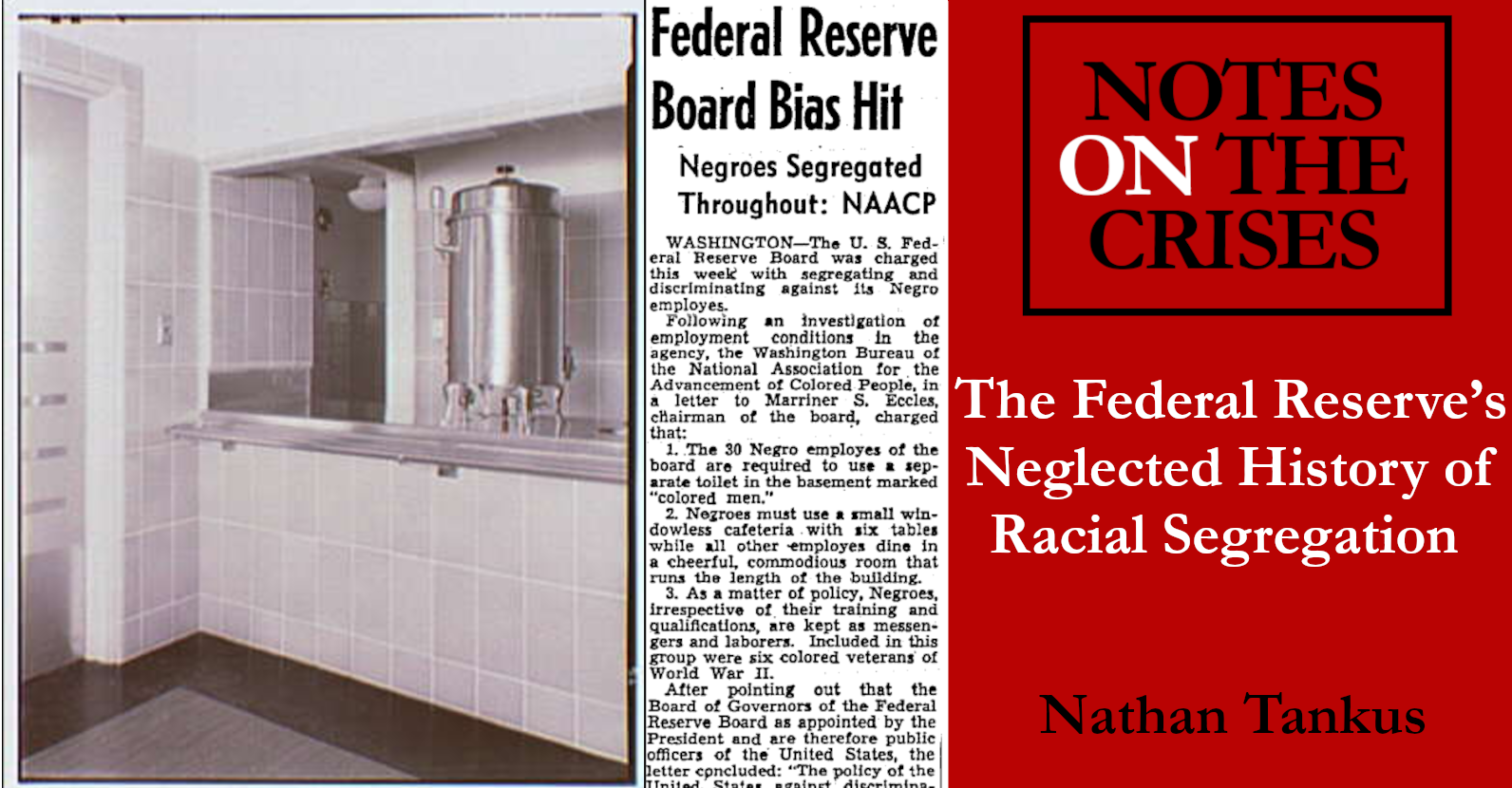

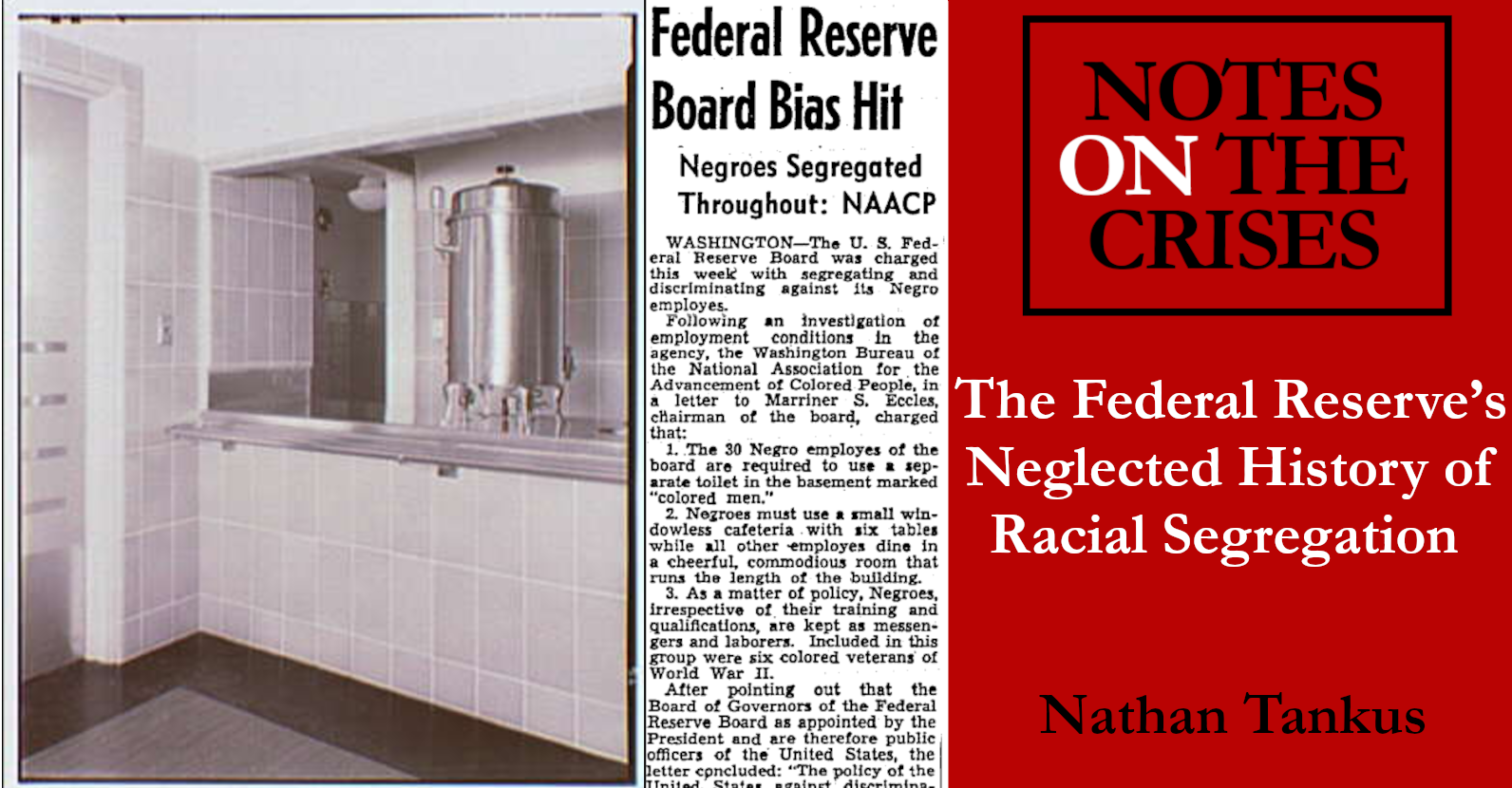

Recent events regarding Lisa Cook’s attempted firing by Donald Trump have convinced me to do a premium series on the history of racial segregation and the Federal Reserve. This is for a

Support Notes on the Crises!

Hello readers; I’m long overdue for major updates across a whole range of issues. I have continued to work full time on Notes on the Crises but

Early last week I started working on a piece on why the Federal Reserve didn’t step in during the Trump Tariff Financial Panic. The basic idea of that piece is simply that

Given recent events, I felt it was finally time to come back and publish this piece. Most of my writing was going to be devoted to piercing the ideology of central bank independence so that the Federal Reserve would be treated like an independent administrative agency like any other.

Exactly seven weeks since the first interview Krugman did with me was published, I have another interview to bring readers -- it's focused on the bread and butter elements that make up a modern financial crisis.

For those just tuning in: I wrote a piece a day for the first three days of this week on what we should probably now term the “Trump Tariff Financial Crisis”. The only missing piece was the international financial architecture part, which is the subject of today’s piece.

Understanding what’s going on during the Trump Tariff stock market panic each day is extremely difficult. All of the most intricate and obscure questions about the Financial System’s “plumbing” become relevant all at once.

It has been a little more than three weeks since my last piece, simultaneously published by Notes On The Crises and Rolling Stone, assessing the extremely alarming implications of the Federal Government taking 80.5 million dollars right out of New York City’s bank account.

I don’t really know what to say. I’ll figure out what to say another time. Paul Krugman, who recently left the New York Times, interviewed me for his newsletter and the transcript of the conversation, as well as the video, are being posted in both of our newsletters.

Notes on the Crises pivoted on February 1st into around the clock coverage of the Trump-Musk Treasury Payments Crisis of 2025. Today is Day Twenty Two

Read Part 0, Part 1, Part 2,