Tomorrow is my 34th Birthday and as such this month's "Birthday" sale is still ongoing. Take advantage today!

Birthday Sale!

Longtime Notes on the Crises readers will remember that

This is a Premium piece of Notes on the Crises.

SubscribeTip!

Federal Reserve governor Lisa Cook was born and raised in Milledgeville Georgia, about a 100 miles away from Atlanta. She also shares

Subscribe Today!

So the federal government is shut down. I’ve been late to covering this story because of my focus on events at the Federal Reserve. Well, that was true when I

Buy a Paid Subscription

The developments in the legal fight between the Federal Reserve Governor Lisa Cook and the second Trump administration have evolved quite rapidly over the past three weeks. It'

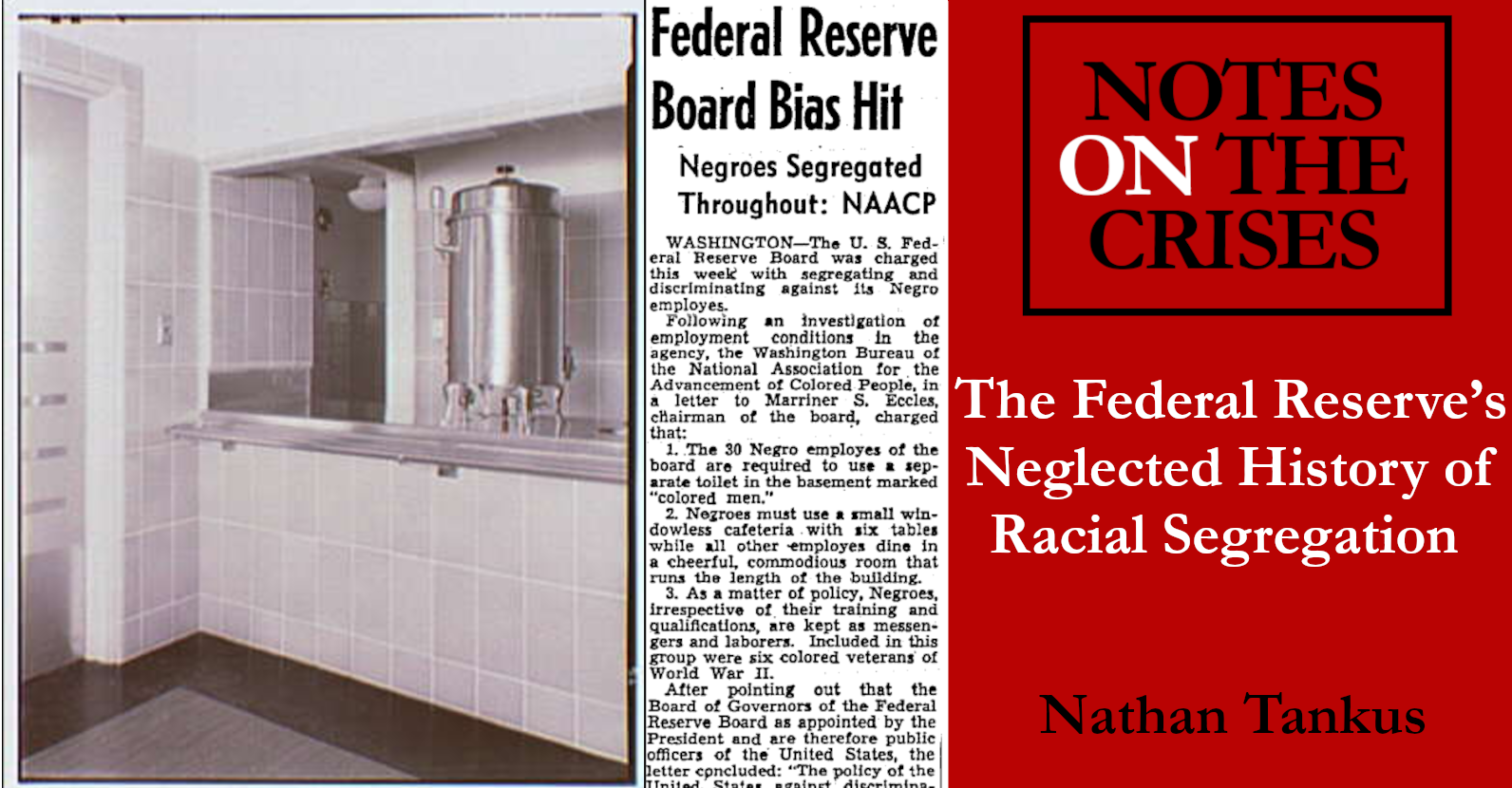

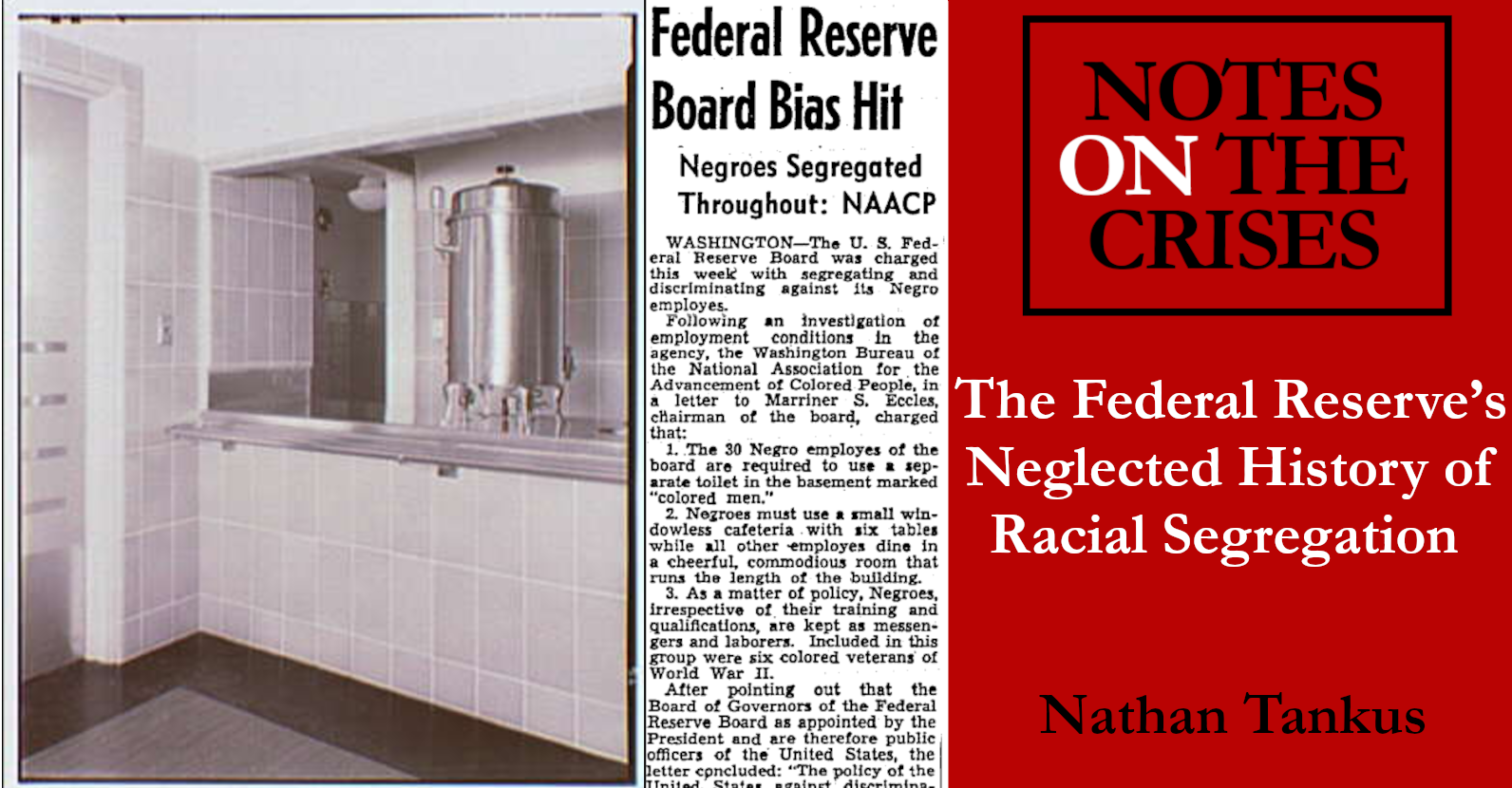

Recent events regarding Lisa Cook’s attempted firing by Donald Trump have convinced me to do a premium series on the history of racial segregation and the Federal Reserve. This is for a

This is a free Notes on the Crises article. A reminder to readers that the various activities run out of the still-new Notes on the Crises office cost money, while an enormous amount

Support Notes on the Crises!

Hello readers; I’m long overdue for major updates across a whole range of issues. I have continued to work full time on Notes on the Crises but

Publisher’s note (Nathan Tankus): A while ago I got the permission of my friends at Bloomberg Oddlots to clean up and publish transcripts of episodes that they didn’t have the time

Given recent events, I felt it was finally time to come back and publish this piece. Most of my writing was going to be devoted to piercing the ideology of central bank independence so that the Federal Reserve would be treated like an independent administrative agency like any other.

Exactly seven weeks since the first interview Krugman did with me was published, I have another interview to bring readers -- it's focused on the bread and butter elements that make up a modern financial crisis.

For those just tuning in: I wrote a piece a day for the first three days of this week on what we should probably now term the “Trump Tariff Financial Crisis”. The only missing piece was the international financial architecture part, which is the subject of today’s piece.

Understanding what’s going on during the Trump Tariff stock market panic each day is extremely difficult. All of the most intricate and obscure questions about the Financial System’s “plumbing” become relevant all at once.