Is There Really A "Looming Bank Collapse?"

A Reply to Frank Partnoy’s Atlantic Feature Article

Is There Really A "Looming Bank Collapse?"

A Reply to Frank Partnoy’s Atlantic Feature Article

We are now back to our regularly scheduled programming. I want to provide a special thank you to my subscribers who stayed with me during my posting break. The ability to be able to take breaks like this when it makes sense (and at some point, to take a research break to catch up on reading in order to replenish my knowledge base for the newsletter) is what will make this newsletter sustainable over a long period of time. I produce thousands and thousands of words every month and hope people can accept me taking periodic breaks when the circumstances make sense. Short breaks from the substack in the future also facilitates my long-form writing which I can now sustainably devote my time to because of this substack. So thanks again for bearing with me and I hope most of you stick with me in the future as I continually shape what this newsletter is. If you’re not a paid subscriber, consider becoming one here.

One of the issues that I haven’t really touched on, despite writing about the Federal Reserve Coronavirus response at length, is the extent to which this crisis threatens the banking system of the United States. Partially this is because there has been so much to cover, and partially I haven’t felt that there are any immediate threats to the banking system. In “A Payments Holiday is More Realistic Than You Think”, I wrote about how a payments holiday would eventually affect the banking system but that was a hypothetical more than anything else. The popular financial press has also not shown much concern about the immediate stability of the banking system. It is worth commenting on this topic at length now because law professor Frank Partnoy has a dire piece in the Atlantic entitled “The Looming Bank Collapse: The U.S. financial system could be on the cusp of calamity. This time, we might not be able to save it.” Don’t you feel terrified just reading that headline and subtitle?

At the Center of Professor Partnoy’s piece are Collateralized Loan Obligations (CLOs). These bear some similarities to the confusing similarly named instruments Collateralized Debt Obligations which were at the center of the 2007-2008 crisis. CDOs were securities made up of risky mortgage backed securities, themselves made up of individual mortgages. collateralized loan obligations meanwhile are made up of individual loans to corporations which already have large amounts of debt. The parallel is obvious and extremely attractive to journalistic accounts of financial markets looking to repeat the drama and intrigue of 2008. Could the banking system collapse in a similar fashion to the way it did in 2008?

Under the surface however, this narrative cracks. One of the early signs that something is off is Partnoy’s claim that

Unless you work in finance, you probably haven’t heard of CLOs, but according to many estimates, the CLO market is bigger than the subprime-mortgage CDO market was in its heyday

This claim has layers of problems in it. Remember that collateralized loan obligations are simpler instruments than collateralized debt obligations. There is one layer between individual loans to corporations and CLOs whereas CDOs were two layers away from individual mortgages. Second, because CDOs were made up of mortgage backed securities, what mortgage backed securities were in them mattered. It's important in this context to know what the purpose of CDOs were. They were the equivalent of kitchen leftovers thrown into a lunch special the next day and cooked in such a way as to hide that they aren’t fresh. CDOs generally took the riskier and lower rated portions of mortgage backed securities and made up entire securities out of them. These “tranches” were designed to retain their value if losses kept below the high single digits and be 100% wiped out if loses went beyond the low double digits. Comparing these irresponsible (and often fraudulent) securities that were made out of securities which were engineered to lose all their value in adverse circumstances to the default risk on conventionally risky loans is a textbook apples to oranges comparison.

The point is, a proper comparison between mortgage securities and syndicated corporate loan securities would compare the value of outstanding “subprime” Mortgage Backed Securities to outstanding Collateralized Loan Obligations, not to Collateralized Debt Obligations. When you do so, you find that CLOs are significantly smaller than the “subprime” MBS market in the run up to the Great Financial Crisis. As Yves Smith at Naked Capitalism says (her whole post on CLOs is itself worth reading and overlaps with much of what I’m saying here):

But should we even care about CLOs? First, the market isn’t all that large. S&P in early 2020 pegged it at $675 billion. By contrast, the subprime market, depending on whether or not you included Alt-As, was estimated back in the day at $1.3 trillion to a bit over $2 trillion

In other words, in nominal dollar terms the current CLO market is ⅓ of the size of the subprime mortgage backed securities market then. This actually understates how relatively paltry Collateralized Loan Obligations are. Gross Domestic Product (or total nominal income) was ⅔ then what is today. If we divide the numbers above by the relevant GDP it emerges that subprime Mortgage Backed Securities were 13.8% of GDP then whereas Collateral Loan Obligations were 3.1% of GDP in 2020. Thus, relative to total nominal income, CLOs outstanding are roughly 22.5% of what mortgage backed securities were then. Partnoy’s article comparing and contrasting today and 2008 never makes this remotely clear.

Let's return to collateralized debt obligation. A skeptical reader may be inclined to say “well, Mortgage Backed Securities may be the proper comparison for collateralized loan obligations, but that doesn’t take away the fact that collateralized debt obligations were central to the Global Financial Crisis. Why is it okay to ignore these securities?”. The key here is to understand that the problems with CDOs were not because of losses on the underlying mortgages. They were dynamite, engineered to explode. The nitroglycerin was not the mortgages but credit default swaps, a type of unregulated insurance that let purchasers bet on whether a specific security was going to fail or not. Many of these collateralized debt obligations were filled with credit default swaps tied to the riskier and lower rated tranches of Mortgage Backed Securities which I discussed earlier, which were guaranteed to fail. In addition, financial market players would bet that the CDOs they just engineered to fail would fail. Their gain was, by definition, someone else’s loss. So they engineered a set of financial transactions which would create explosive losses throughout the financial system. Imagine if the restaurant in my metaphor had rigged an entire city to explode if the rotten food they fed customers gave customers diarrhea.

Partnoy is completely misleading on this point because he completely fails to distinguish these instruments that were engineered to fail- and explode when they failed- from Collateralized Loan Obligations which are structured like Mortgage Backed Securities and have no such self-destruct mechanisms. He is worth quoting at length on this point:

Congress also tried to reform the credit-rating agencies, which were widely blamed for enabling the meltdown by giving high marks to dubious CDOs, many of which were larded with subprime loans given to unqualified borrowers. Over the course of the crisis, more than 13,000 CDO investments that were rated AAA—the highest possible rating—defaulted. The reforms were well intentioned, but, as we’ll see, they haven’t kept the banks from falling back into old, bad habits

There are many things one can criticize Wall Street for, but it is simply not true that there has been anything going on that remotely resembles the fraudulent explosive devices that were Credit Default Swap fueled Collateralized Debt Obligations made out of the leftover dreck of Mortgage Backed Securities during the Great Financial Crisis. One way of recognizing how fundamentally different circumstances are is by examining what happened to AAA rated mortgage backed securities. If, as Partnoy implies, the losses on CDOs were simply a matter of defaults on the underlying mortgages, triple A rated Residential Mortgage backed Securities should have taken losses comparable to CDOs. No such thing occurred. Yves Smith usefully points out, AAA rated mortgage backed securities ended up averaging roughly 0.5% of losses by 2013. This is more loss than triple A rated securities should have taken, but it is not the kind of loss one would expect if the underlying mortgages were the dominant factor leading to problems with CDOs.

As Partnoy’s piece unravels, what is disturbing is the near complete absence of the central ingredient of the Great Financial Crisis in a feature article that purports to compare the current crisis to the Great Financial Crisis to find similarities and differences. A shocking 28 paragraphs deep into the article, credit default swaps merit a one sentence mention:

And some of the most irresponsible gambles from the last crisis—the speculative derivatives and credit-default swaps you may remember reading about in 2008—are less common today, experts told me. But the losses from CLOs, combined with losses from other troubled assets like those commercial-mortgage-backed securities, will lead to serious deficiencies in capital

Losses from this crisis may lead to “serious deficiencies in capital”, but if they do it will not be because of fancy structured products but the failure of good old-fashioned loans because of a good old-fashioned depression. In fact, it’s likely that collateralized loan obligations made up of the top portion of a portfolio of loans will do the best of any of the Bank’s corporate loans. When a bank originates and holds a loan, it immediately takes losses if the borrower defaults. In contrast, it takes very substantial levels of defaults before holders of the top portion, or “senior tranche” of a collateralized loan obligation realize any losses. For any given portfolio of loans, given the same overall default rate and the same loan modifications, senior tranche holders will experience less losses than outright holders of a portfolio of loans. This structure may encourage originating lower quality loans and investors may overpay as a result of tranches being mis-rated by credit rating agencies. However, it can’t be said that this structure, in and of itself, magnifies losses for investors in the senior tranche. In fact, it works as intended- other investors bear the bulk of the risks.

It is true that, by the beginning of 2014, a second layer emerged on top of Collateralized Loan Obligations that are referred to as “Collateralized Synthetic Obligations”. However, the similarity stops there. The market for these instruments are smaller, completely illiquid and the risk is held in full by investors far removed from Chartered Banks. Guggenheim investments summarized the differences well in March of this year:

Today’s post-crisis CSOs look considerably different to their pre-crisis counterparts. First, tenors for recent CSOs are considerably shorter, ranging from one to five years. Second, unlike pre-crisis CSOs, the CSO debt tranches are no longer rated. Before 2008, banks selectively “optimized” CSO collateral pools and structures for the specific purpose of earning an investment-grade rating; no rating agency has rated CSO debt since the financial crisis. Finally, underwriting banks now issue and sell all the debt and equity in a CSO and do not retain any tranche risk. Post-crisis bank regulations have either prohibited or made uneconomic the ownership, trading, and warehouse financing of CSO risk.

There is no evidence that explosive bets are being taken anywhere near the banking system based on Collateralized Synthetic Obligations. After all, doing so would be uneconomic as these portfolios are unrated credit risks. Credit Default Swaps themselves have greatly shrunk since the Global Financial Crisis. As the Office of the Comptroller of the Currency reports, as of the 4th quarter of 2019:

Credit derivatives outstanding remained well below the peak of $16.4 trillion in the first quarter of 2008 (see graph 1 in the appendix). As shown in figure 5, credit default swaps are the dominant product, at $3.5 trillion (87.7 percent) of all credit derivative notional amounts.

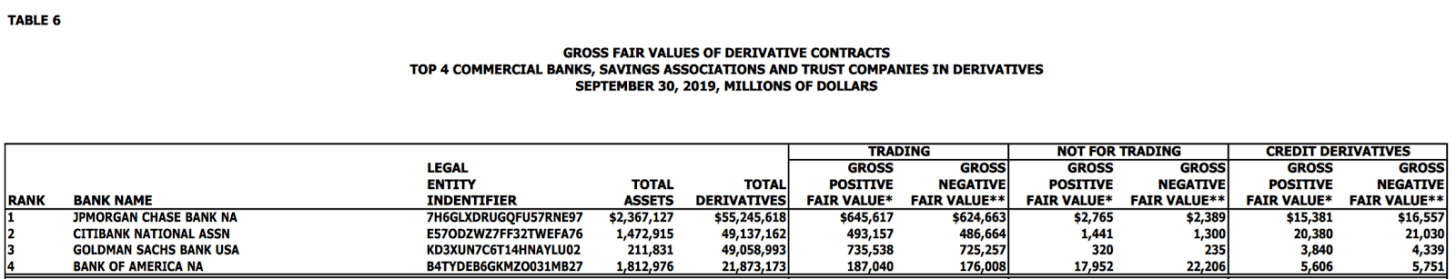

In fact, the extremely useful OCC report provides a handy table calculating the maximum amount that the four largest banks would lose on their credit derivatives they own if all their counterparties defaulted. This concept is known as “Gross Positive Fair Value” and the table below shows that Citibank would lose the most, with 21 billion dollars. Given that the net exposures are far smaller than this, it is not credible to claim that credit default swaps represent a major threat to bank balance sheets today that they did in 2008.

The key takeaway here is that the financial instruments which blew up the world financial system in 2008 are not present in the quantities, combinations and locations that they would need to be to threaten a crisis today. To the extent we are facing a financial crisis today, it is because of conventional credit risk due to a pandemic-induced depression. There is no sexy investigative narrative at the center of the macroeconomic issues we face today and the fact that there was one 12 years ago has greatly hampered the approach to macroeconomics which has prevailed in the popular press. All that being said, it may still be possible that collateralized loan obligations themselves are a boring threat to bank balance sheets. Let’s examine the evidence Partnoy provides for this.

The deft, but misleading, rhetoric of Professor Partnoy’s piece is best captured in the following passage:

Nestled among them is an item called “collateralized loan and other obligations”—CLOs. I ran my finger across the page to see the total for these investments, investments that Powell and Mnuchin have asserted are “outside the banking system.”

The total is $29.7 billion. It is a massive number. And it is inside the bank.

The way Partnoy puts it, you can practically hear the throbbing of a Collateralized Loan Obligation inside the bank, pounding away like the “chestburster” in Alien. But wait, how do we know that that is a “massive number”? Professor Partnoy relies on our inherent fear of large numbers to paper over the thinness of this claim. Returning to the OCC report, we find out that Wells Fargo has more than 1.7 trillion dollars in assets. 29.7 billion is about 1.7% of Wells Fargo assets. CLOs are similarly minor for the other large banks. There investments are also restricted to the top tranches, which as we explained earlier really do have a very substantial cushion of losses. Even in the extreme scenario where every single CLO experiences 100% losses, the exposure of the Global Systemically Important Banks is minor. Even Partnoy acknowledges that their total holdings of leveraged corporate loans overall amount to just 60% of tier 1 capital. High yield corporate debt is certainly a financial risk for the banking system but that story is far more boring and conventional than Professor Partnoy wants to present it as. His premise completely falls apart once you get to the 30th paragraph but this fact is papered over by the mountain of prose.

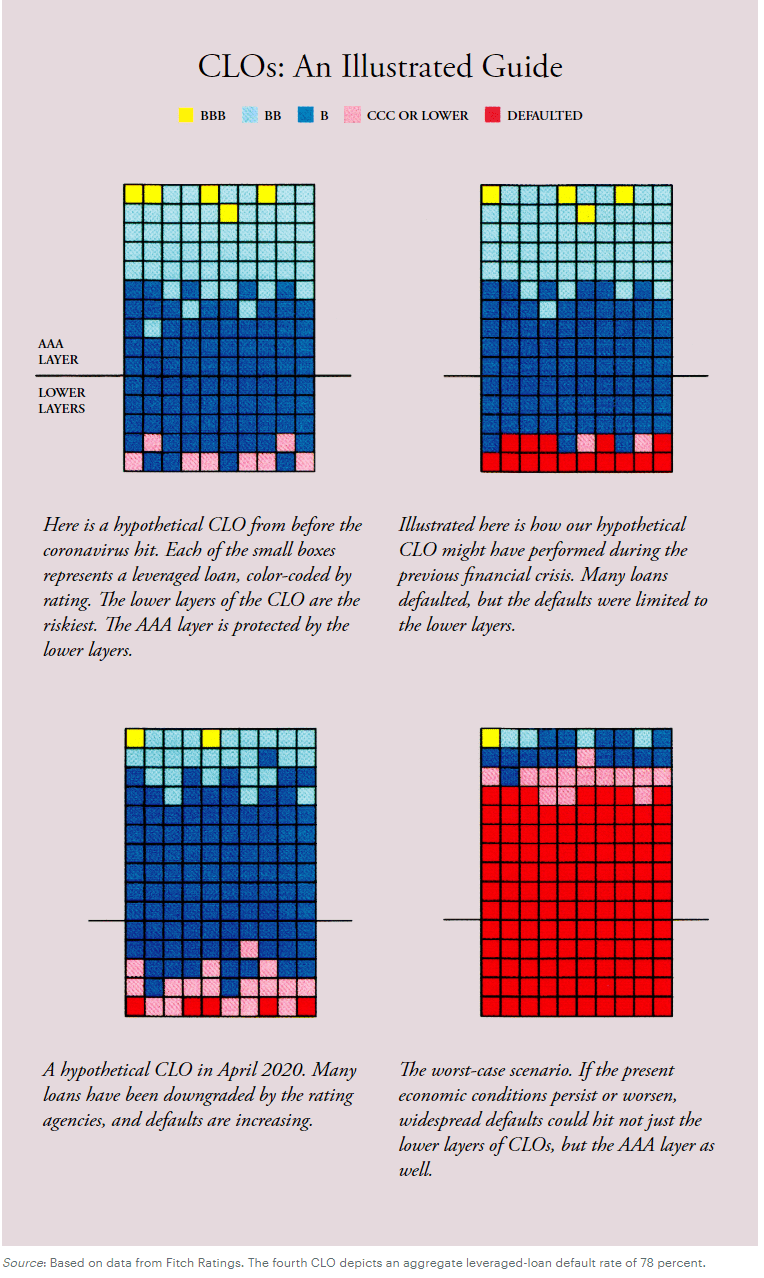

This, of course, doesn’t stop Partnoy who solidifies his case with powerful hypotheticals. One of the scariest parts of this article is actually a graphic that portrays purely hypothetical default events while not contextualizing them relative to bank balance sheets or the likely actual losses from default.

Partnoy implicitly justifies slipperiness between a default event and total losses by claiming that

We already know that a significant majority of the loans in CLOs have weak covenants that offer investors only minimal legal protection; in industry parlance, they are “cov lite.” The holders of leveraged loans will thus be fortunate to get pennies on the dollar as companies default—nothing close to the 70 cents that has been standard in the past.

While it's true that financial covenants by definition provide lenders greater protection, it is a completely arbitrary assertion on Professor Partnoy’s part that this means losing 60% or more of the principal of leveraged loan holdings, especially on the triple A rated portion of CLOs. His narrative requires such maximal assumptions because otherwise it appears that only a small portion of tier 1 capital is threatened by even widespread default events.

Nearing the end of this journey, we arrive at Partnoy’s retelling of the liquidity aspects of the Great Financial Crisis.

You can perhaps guess much of the rest: At some point, rumors will circulate that one major bank is near collapse. Overnight lending, which keeps the American economy running, will seize up. The Federal Reserve will try to arrange a bank bailout. All of that happened last time, too.

Partnoy goes on to spin a narrative where a bailout is not forthcoming but his narrative about a liquidity crisis loses force from the start. He doesn’t seem to be aware that our largest banks have far larger liquidity buffers because of Basel III or that the Federal Reserve has made liquidity abundant from the very beginning of this crisis, which makes this crisis very different from 2007-2008. The discount window is freely available for short term and long term loans and intraday credit is being extended on an unlimited and uncollateralized basis. There is no unsecured interbank loan market for concerns about credit worthiness of our largest banks to be transmitted through. The banking system fundamentally does not have any liquidity problems today.

Without liquidity issues, the time-sensitive and frenetic politics of last minute bailouts which are central to the final leg of his narrative disappear. In its place we have a technical, bureaucratic and slow-moving conversation about capital adequacy where regulators have a large degree of discretion. In our current circumstances it would have to be regulators pushing for immediate recognition of large losses which threaten the capital of the banking system. As I’ve written about a number of times in this newsletter, regulators are doing the opposite of this. They are delaying or not requiring classifying loans with deferred payments as “troubled debt restructurings” and are actively encouraging banks to “work with” borrowers. They will likely pursue more forbearance in the future. Thus there is little reason to think that either capital or liquidity issues pose any immediate threat to the banking system. We will see how potential future losses play out but Partnoy’s speculative hypothetical is not remotely convincing.

What is Professor Partnoy’s motivation for this piece? One of the final sections of his very long feature points the way:

And then, sometime in the next year, we will all stare into the financial abyss. At that point, we will be well beyond the scope of the previous recession, and we will have either exhausted the remedies that spared the system last time or found that they won’t work this time around. What then?

Until recently, at least, the U.S. was rightly focused on finding ways to emerge from the coronavirus pandemic that prioritize the health of American citizens. And economic health cannot be restored until people feel safe going about their daily business. But health risks and economic risks must be considered together. In calculating the risks of reopening the economy, we must understand the true costs of remaining closed. At some point, they will become more than the country can bear.

The financial sector isn’t like other sectors. If it fails, fundamental aspects of modern life could fail with it. We could lose the ability to get loans to buy a house or a car, or to pay for college. Without reliable credit, many Americans might struggle to pay for their daily needs. This is why, in 2008, then–Treasury Secretary Henry Paulson went so far as to get down on one knee to beg Nancy Pelosi for her help sparing the system. He understood the alternative.

This seems to be the real motivation of this entire exercise. In Partnoy’s view, financial support to the banking system is unlikely so we must end the depression by opening up the economy and then we must make the financial system safer with even heavier regulation. Besides the fact that reopening the economy will not work to end the economic pain, Partnoy is wrong to suggest that the banking system will not receive liquidity support because it is already doing so. He is wrong to imply that the standard rescue toolbox will not work because it is already doing so. The Federal Accounting Standard Board was also key to alleviating pressure on Bank balance sheets during 2008. We don’t need to sacrifice people for the sake of the financial sector.

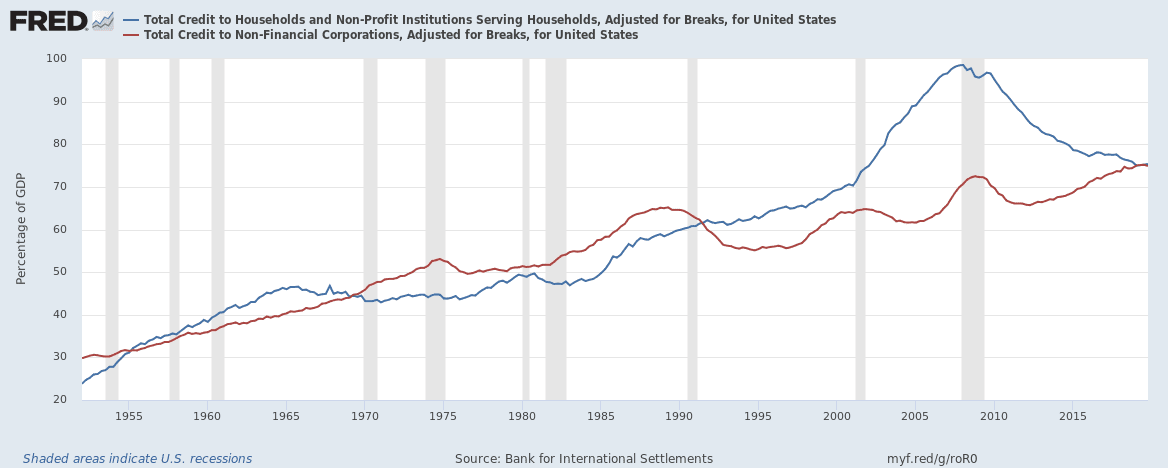

Regulating the banking system more rigorously is, of course, a good idea. But the lack of implementation of good ideas doesn't add up to a crisis. We are not in this crisis because below investment grade corporate debt was issued in substantial quantities over the last decade. Portnoy’s narrative completely fails to acknowledge that going into this crisis, non-financial corporations had 23% less debt relative to GDP than households did at the beginning of 2008.

Even greater deleveraging by the private sector would have required larger government deficits which is precisely the kind of “government intervention” that Professor Partnoy’s doomsday scenario assumes away.

To sum up

- No, collateralized loan obligations are not a major systematic risk to the banking system

- No, collateralized loan obligations are not like Collateralized Debt Obligations

- The Great Financial Crisis was a credit default swap crisis, not a mortgage crisis

- Credit Default Swaps are not threatening another banking crisis

- Even the leveraged loan market is only somewhat important macroeconomically

- Liquidity and capital issues are being handled differently today

- Leveraged loan issuance is not the major cause of financial distress among businesses

We have a lot of problems right now, we don’t need made up ones.

Stay Safe,

Nathan Tankus

If you liked this comprehensive deep dive, please consider taking out a paid subscription here. It is support by readers like you which make this kind of in-depth analysis and explanation possible.

Sign up for Notes on the Crises

Currently: Comprehensive coverage of the Trump-Musk Payments Crisis of 2025